Payment processing is a crucial component of modern commerce that enables businesses to handle customer transactions efficiently and securely. Whether you operate an online store, a brick-and-mortar shop, or provide services to customers, understanding the ins and outs of payment processing is essential to running a successful business. In this blog, we’ll explore what payment processing is, how it works, and why it’s vital for businesses of all sizes.

The Basics of Payment Processing

Payment processing refers to the series of steps involved in facilitating a financial transaction between a customer and a business. This process involves several entities working together to ensure that funds move from the customer’s account to the business’s account securely and efficiently.

How Payment Processing Works

- Customer Initiates Payment: The process begins when a customer decides to make a purchase and provides payment information, such as credit card details, eCheck information, or another method of payment.

- Payment Gateway: The payment information is sent through a secure payment gateway. The gateway acts as an intermediary between the customer and the merchant, encrypting and securely transmitting data.

- Authorization: The payment gateway contacts the customer’s bank or financial institution to request authorization for the transaction. This step verifies the availability of funds and confirms that the transaction is legitimate.

- Transaction Approval: Once the customer’s bank approves the transaction, the payment gateway sends a confirmation to the merchant. The merchant can then proceed with fulfilling the order or providing the service.

- Settlement: After the transaction is approved, the funds are transferred from the customer’s account to the merchant’s account. This process is known as settlement and can take a few business days to complete.

- Transaction Reconciliation: The final step is reconciling the transaction records, ensuring that all payments have been processed correctly and accurately.

Types of Payment Processing

- Credit Card Processing: The most common form of payment processing, credit card processing involves accepting payments from customers using credit or debit cards.

- Echeck Payment Processing: Echecks, or electronic checks, enable customers to make payments by providing their bank account information. This type of processing is popular for recurring payments, such as subscriptions.

- ACH Processing: Automated Clearing House (ACH) payments allow customers to make electronic transfers directly from their bank accounts. ACH is often used for bill payments and direct deposits.

- Digital Wallets: Digital wallets, such as PayPal and Apple Pay, provide a secure and convenient way for customers to make payments without entering credit card information.

- Mobile Payments: Mobile payment solutions enable customers to make transactions using their smartphones, either by scanning QR codes or using apps like Venmo or Cash App.

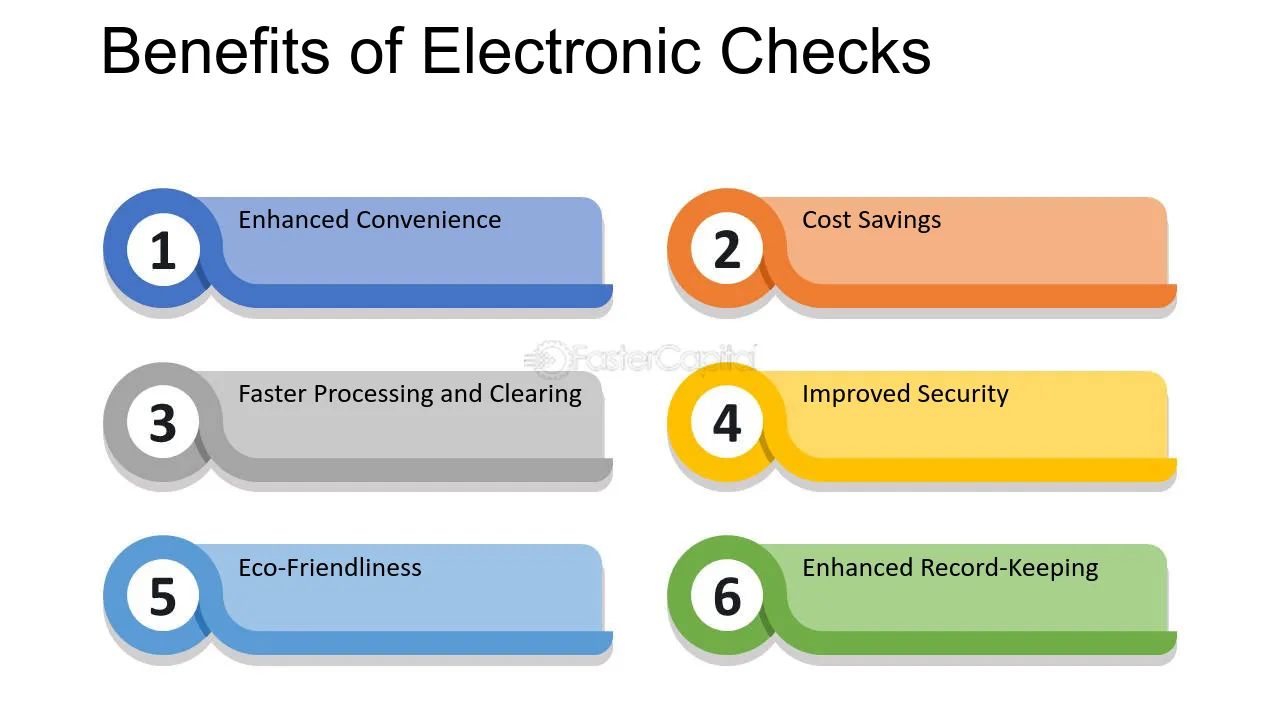

Benefits of Payment Processing

- Convenience: Payment processing offers customers a range of payment options, making it easy for them to complete transactions.

- Security: Secure payment gateways protect sensitive customer information and help prevent fraud.

- Speed: Transactions are processed quickly, allowing businesses to fulfill orders and provide services efficiently.

- Integration: Payment processing can be seamlessly integrated into a business’s existing systems, such as point-of-sale (POS) and e-commerce platforms.

- Analytics: Payment processing services often provide businesses with valuable insights into customer spending habits and trends.

Choosing the Right Payment Processor

Selecting the right payment processor is crucial for any business. Here are some factors to consider when making your decision:

- Fees and Pricing: Compare transaction fees, monthly fees, and other costs associated with different payment processors.

- Security Features: Ensure the payment processor offers robust security measures, such as encryption and fraud protection.

- Compatibility: Choose a payment processor that integrates seamlessly with your existing systems and platforms.

- Customer Support: Opt for a payment processor that offers reliable customer support to assist you with any issues or questions.

- Reputation: Research the reputation and track record of the payment processor to ensure you choose a trustworthy partner.

Conclusion

Payment processing is the backbone of modern commerce, enabling businesses to accept payments from customers securely and efficiently. By understanding how payment processing works and choosing the right payment processor, businesses can streamline their financial operations, improve customer satisfaction, and ultimately drive growth.