In today’s fast-paced e-commerce landscape, offering a smooth and convenient checkout experience is crucial for customer satisfaction and conversion rates. Traditional credit card processing often comes with hefty fees and potential delays. Enter instant ACH payments – a game-changer for online stores seeking a secure, cost-effective way to accept payments.

What are Instant ACH Payments?

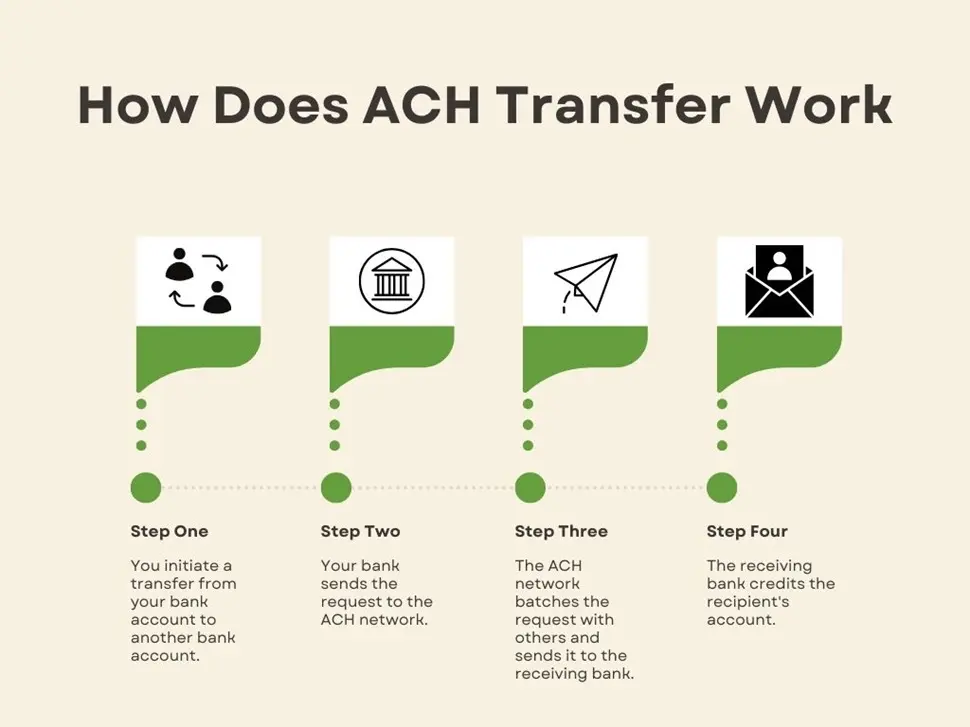

Let’s break it down. ACH stands for Automated Clearing House, a network that facilitates electronic funds transfers between banks in the United States. Unlike traditional ACH transfers that can take several business days to settle, instant ACH payments offer near-real-time processing, meaning funds are deposited into your account almost instantly after a customer completes their purchase. This translates to faster access to your revenue and a more streamlined experience for your customers.

Benefits of Instant ACH for Online Stores:

Reduced Costs: Compared to credit card processing fees, instant ACH payments boast significantly lower transaction costs. This can significantly boost your profit margins, especially for high-volume businesses.

Faster Settlements: No more waiting days for funds to clear. Instant ACH deposits funds into your account almost immediately after a successful transaction. This improves your cash flow and simplifies financial management.

Enhanced Security: ACH payments utilize robust security protocols, including bank-level authentication, to minimize fraud risks. This protects both your business and your customers’ sensitive financial information.

Improved Customer Experience: A frictionless checkout experience is key to keeping customers happy. Instant ACH offers a convenient and familiar payment option, eliminating the need for credit card details and streamlining the buying process.

Wider Customer Reach: Not everyone has a credit card, or prefers to use it online. By offering instant ACH, you cater to a broader customer base and potentially increase your sales volume.

Getting Started with Instant ACH Payments:

Setting up instant ACH payments for your online store is a relatively straightforward process. Here’s a step-by-step guide:

1. Choose a Payment Processor: Several payment processors offer instant ACH integration. Research and compare options to find a provider that aligns with your business needs and budget. Consider factors like transaction fees, supported platforms, and customer service reputation.

2. Integrate the Payment Gateway: Work with your chosen payment processor to integrate their instant ACH gateway with your online store’s shopping cart platform. This involves following the provider’s specific instructions and configuring your shopping cart settings.

3. Set Up Your Account: Provide the payment processor with your business information and bank account details. This allows them to facilitate the transfer of funds from your customers’ banks to your account.

4. Update Your Checkout Page: Clearly display instant ACH as a payment option on your checkout page. You might also want to include a brief explanation of its benefits to educate your customers on this payment method.

Beyond the Basics: Considerations for Instant ACH

While instant ACH offers significant advantages, there are a few things to keep in mind:

Not All Banks Support Instant ACH: While adoption is growing, some banks might not yet offer instant ACH functionality to their customers. Be prepared for a small percentage of failed transactions due to lack of bank support.

Potential for Chargebacks: As with any electronic payment, there’s a risk of chargebacks (customers disputing a transaction).

eCheck Payments vs. Instant ACH:

Sometimes, eCheck payments are presented as an alternative to instant ACH. While both are electronic methods of transferring funds, there are key differences:

Processing Time: eChecks are essentially electronic versions of paper checks, meaning they can take several business days to clear. Instant ACH, on the other hand, offers near-real-time settlement.

Security: Both methods utilize bank-level authentication, but instant ACH might offer additional fraud prevention measures due to its real-time processing capabilities.

Conclusion:

Incorporating instant ACH payments into your online store’s payment options can be a strategic move. It offers cost-effectiveness, faster settlements, enhanced security, and a wider customer reach. By following these steps and keeping the considerations in mind, you can seamlessly integrate this payment method and unlock a new level of efficiency for your e-commerce business.