In the fast-paced world of lending, where transactions are the lifeblood of your business, selecting the right payment processor is paramount. Whether you’re a traditional lender, an online lending platform, or a fintech startup, the payment processor you choose can significantly impact your operations, customer experience, and bottom line. In this comprehensive guide, we’ll explore the key factors to consider when evaluating payment processors for your lending company and help you make an informed decision that aligns with your business goals and objectives.

Understanding the Importance of Payment Processors for Lending Companies

Payment processors serve as the bridge between your lending company and your customers, facilitating the seamless transfer of funds for loan disbursements, repayments, and other financial transactions. As such, the payment processor you choose plays a critical role in shaping the overall experience for both borrowers and lenders. Here’s why selecting the right payment processor is crucial for your lending company:

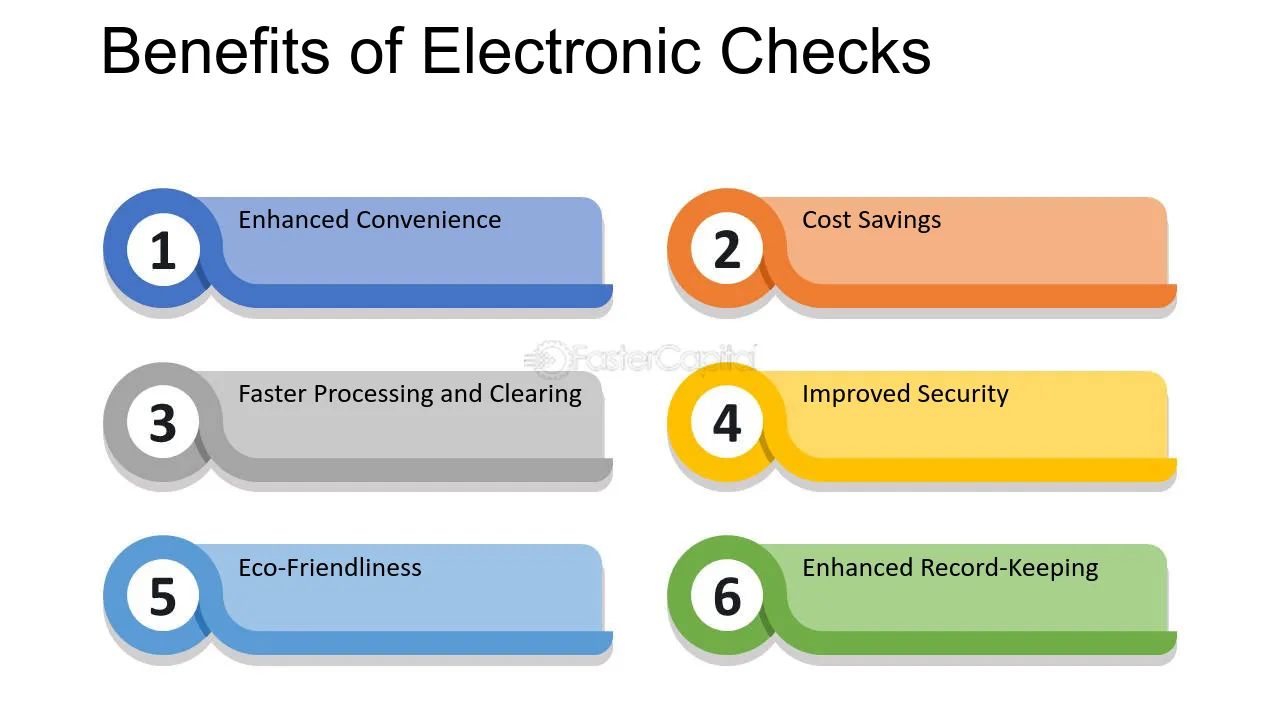

- Security and Compliance: Payment processors must adhere to strict security standards and compliance regulations, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation), to protect sensitive financial data and ensure regulatory compliance.

- Transaction Speed and Reliability: In the lending industry, timing is everything. A reliable payment processor with fast transaction processing times ensures that loan disbursements and repayments are processed promptly, minimizing delays and disruptions for both borrowers and lenders.

- Flexible Payment Options: Your payment processor should support a wide range of payment methods, including credit cards, debit cards, ACH transfers, and alternative payment options, to accommodate the diverse needs and preferences of your customers.

- Scalability and Growth: As your lending company grows, your payment processing needs may evolve. Choosing a payment processor that can scale with your business and adapt to changing requirements ensures that you can continue to meet the needs of your expanding customer base.

- Integration with Lending Software: Seamless integration with your lending software or platform is essential for streamlining operations and automating key processes, such as loan origination, underwriting, and servicing. Look for payment processors that offer robust APIs and easy integration capabilities.

Key Factors to Consider When Evaluating Payment Processors

When evaluating payment processors for your lending company, consider the following factors to ensure you choose the right solution for your business:

1. Security and Compliance:

- Ensure that the payment processor adheres to industry-leading security standards and compliance regulations to protect sensitive financial data and mitigate the risk of fraud or data breaches.

2. Transaction Fees and Pricing Structure:

- Understand the pricing structure and associated fees, including transaction fees, monthly service fees, chargeback fees, and any additional charges for value-added services. Compare pricing plans from multiple providers to find the most cost-effective solution for your lending company.

3. Transaction Processing Speed:

- Choose a payment processor with fast transaction processing times to ensure that loan disbursements and repayments are processed promptly, minimizing delays and improving the overall customer experience.

4. Payment Method Support:

- Look for a payment processor that supports a wide range of payment methods, including credit cards, debit cards, ACH transfers, and alternative payment options, to accommodate the diverse needs and preferences of your customers.

5. Integration and Compatibility:

- Ensure that the payment processor seamlessly integrates with your lending software or platform, allowing for easy data transfer and automation of key processes. Look for providers that offer robust APIs and developer-friendly tools for smooth integration.

6. Customer Support and Service:

- Consider the level of customer support and service provided by the payment processor. Choose a provider that offers responsive customer support, technical assistance, and resources to help you navigate any issues or challenges that may arise.

7. Reporting and Analytics:

- Look for payment processors that offer comprehensive reporting and analytics tools to track transaction volumes, monitor payment trends, and gain insights into your lending company’s financial performance.

8. Scalability and Flexibility:

- Choose a payment processor that can scale with your lending company as it grows and evolves. Look for providers that offer flexible solutions and customizable features to accommodate changing business needs.

Conclusion Choosing the right payment processor is a critical decision for your lending company, with far-reaching implications for your operations, customer experience, and overall success. By considering factors such as security, transaction fees, payment method support, integration capabilities, and customer service, you can select a payment processor that meets your specific needs and objectives. With the right payment processor in place, you can streamline transactions, enhance security, and provide a seamless experience for borrowers and lenders alike, positioning your lending company for sustainable growth and success in the competitive financial services industry.