Ensure Secure Verification and Acceptance of eChecks

iPay Digital advanced eCheck payment processing ensures smooth and secure transactions, allowing your business to accept electronic checks with ease.

Embrace a secure payment environment with our cutting-edge eCheck processing, safeguarding your transactions and customer data.

Register now and commence bank account debits today! Get Started Now.

How it works

Convallis ullamcorper aliquet ultrices orci cum vestibulum lobortis erat.

Capture Customer's Bank Information

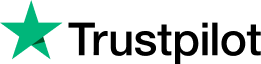

Payment is Verified Instantly

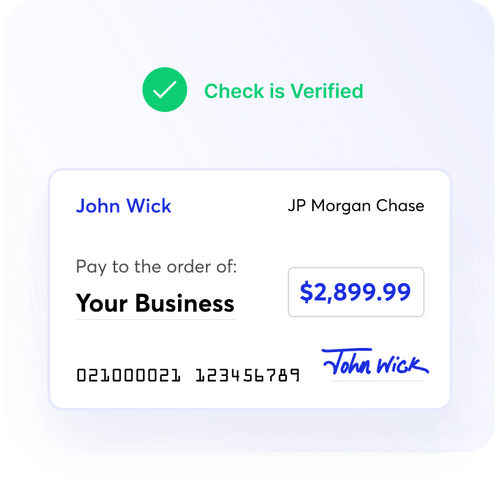

Funds are Deposited into your Bank Account

Our Core Features

Real-Time Verification

Store Payment Methods

Capture Authorization

Payment Links

Email Invoicing

Bulk Upload via CSV or Excel

Shopping Cart Integrations

Recurring Billing

Signature Capture

Simplify Your Payments Today.

- Same Day Setup

- No Transaction Limits

- Same or Next Day Deposits

- Verify your first check for free

- No Reserve

Say Goodbye to Excessive Credit

Card Fees

Cost-Efficient Solutions: Tired of high credit card processing fees? Explore our services designed to help you minimize costs and maximize profits..

Transparent Pricing: Say goodbye to hidden fees. Our transparent pricing model ensures you know exactly what you’re paying for, empowering you to manage your finances more effectively.

Content for Embracing

Approval Benchmark

High Approval Rates: Experience an impressive approval benchmark with our eCheck payment services, ensuring that your business can thrive without unnecessary hurdles.

Tailored Solutions: Our eCheck solutions are customized to meet the unique needs of your business, providing a seamless experience while ensuring a high approval rate for your transactions.

iPay Digital Plans

Same or Next Day Bank Deposits

- eCheck Processing

- No Setup or Cancellation Fees

- No Reserve

- No Transaction Limit

- Payment Page / Enter Payment

- Payment Page / Enter Payment

Contact sales

- If you are doing over $100,00 in transactions a month - Contact Sales to:

- Accept unlimited checks

- Advanced verification

- Manual check entry

- Payment Links

- Recurring billing

- Access to our API

- Bank balance confirmation

You’re in good company

Thousands of business owners trust iPay Digital to help them accept payments.

iPay Digital Merchant has been an invaluable asset to our organization, offering prompt responses and a delightful collaboration.

Their expertise in managing payment processing fees has been exceptional, keeping our costs to a minimum.

Thanks to iPay Digital Merchant's outstanding service and guidance, our ecommerce operations have become significantly more efficient.

Implementing eCheck verification has slashed returned checks for our clients by 63%, resulting in substantial savings on bank fees.

Reliable verification and responsive customer service make iPay Digital a trusted partner in our business operations.

The reduction in mailed checks, thanks to iPay Digital, has not only saved us money but also valuable time.

iPay Digital has streamlined our money collection process, making it faster, easier, and more efficient.

Exceptional service! iPay Digital's online payment system has significantly reduced accounts receivable by facilitating quick and secure transactions.

Addressing a crucial business need, iPay Digital has resolved our recurring payment challenges with vendors.

iPay Digital's user-friendly platform enables effortless one-time and recurring rent payments from our tenants.

Effortlessly receiving funds the next day from clients has become a seamless part of our business process, thanks to iPay Digital.

Every small business should embrace iPay Digital for quick, secure, and reliable payments.

iPay Digital has been a game-changer for our company, drastically reducing the time it takes to receive payments.

FAQ About eChecks

An eCheck, short for electronic check, is a digital version of a traditional paper check used for online payments. It serves as an electronic representation of a customer’s paper check, containing the same information such as the bank account number, routing number, and payment amount. When a customer initiates an eCheck payment, the information is securely transmitted over the Automated Clearing House (ACH) network, allowing for the electronic transfer of funds from the payer’s bank account to the payee’s account. eChecks are a convenient and secure alternative to paper checks, offering businesses and consumers a reliable method for conducting electronic transactions with reduced processing costs compared to credit cards.

eChecks, or electronic checks, simplify the payment process by digitizing traditional check payments. The payer initiates the transaction by entering payment details online, including the amount and bank account information. This information is securely transmitted through the Automated Clearing House (ACH) network, where the payer’s bank account is verified, and authorization is obtained. Subsequently, the payment amount is electronically debited from the payer’s account and transferred to the payee’s account through the ACH network. The entire process, from initiation to settlement, typically takes a few business days. Both parties receive confirmation, and the payee gains access to the funds, making eChecks a secure and efficient method for online transactions.

To accept eCheck payments, you’ll need to set up an online payment gateway that supports electronic checks. First, ensure that your business has a merchant account capable of processing eChecks. Integrate the chosen payment gateway into your website or payment system, allowing customers to select the eCheck option during checkout. Once a customer provides their bank account details, the payment information is securely transmitted through the Automated Clearing House (ACH) network. The ACH network verifies the account details and processes the transaction. As a merchant, you receive confirmation of the eCheck payment, and the funds are typically deposited into your account within a few business days. Make sure to communicate to your customers that eCheck payments are a convenient and secure option, and provide clear instructions on how to choose this method during the payment process.

The processing time for eChecks typically takes a few business days. Unlike traditional paper checks, eChecks go through an electronic clearing process facilitated by the Automated Clearing House (ACH) network. Once a customer initiates an eCheck payment, the transaction information is transmitted securely through the ACH network, where the payer’s bank verifies the account details and processes the payment. The entire cycle, from initiation to fund transfer, may take several days, depending on the banks involved and their processing times. It’s important to communicate this timeline to customers, setting clear expectations regarding the processing duration of eCheck payments.

People use eChecks for various reasons, appreciating the convenience and efficiency they offer in digital transactions. EChecks eliminate the need for paper checks, providing a faster and more secure alternative for making payments. They are particularly favored for online purchases and recurring payments, offering a straightforward way to transfer funds directly from a bank account. Additionally, eChecks are often chosen for their cost-effectiveness, as they can bypass some of the fees associated with credit card transactions. The ease of initiating eCheck payments, coupled with their reliability, makes them a preferred choice for individuals and businesses seeking a reliable and electronic means of payment.

ACH (Automated Clearing House) and eCheck are terms often used interchangeably, but they refer to distinct aspects of the electronic payment process. ACH is the overarching network that facilitates various electronic transactions, including eChecks. An eCheck, on the other hand, specifically refers to an electronic version of a paper check. While both ACH and eCheck involve the transfer of funds electronically, eCheck usually mimics the format of a traditional check, including the payer’s bank account and routing numbers. ACH encompasses a broader spectrum, including various electronic transactions beyond checks. In essence, an eCheck is a type of payment that utilizes the ACH network for its electronic transfer, highlighting the relationship between the two terms within the realm of digital financial transactions.

The fees associated with eChecks can vary depending on the payment processor or financial institution involved. Some providers may offer eCheck services with no additional fees, while others might charge a nominal fee for processing. It’s advisable to check with your specific service provider or bank to understand their fee structure for eCheck transactions. Keep in mind that compared to traditional payment methods like credit cards, eChecks are often considered a cost-effective option, especially for larger transactions, as they may come with lower processing fees or even no fees in certain cases.

- Employer Identification Number (EIN): A unique identifier assigned to a business entity by the IRS, the EIN is crucial for verifying the legitimacy of the business.

- Bank Balance ($10,000): Some eCheck processing may require proof of a minimum bank balance to ensure financial stability and the ability to cover transactions.

- Driver’s License

- Driver’s License: A valid driver’s license may be needed to verify the identity of the individual or authorized representative associated with the eCheck transactions.

- Voided Check or Bank Letter: Providing a voided check or a bank letter confirms the account details, ensuring accurate processing of eCheck transactions.

- Articles of Incorporation: For businesses, submitting the Articles of Incorporation is often necessary to validate the legal status and structure of the company.