Seamlessly Accept ACH Payments Through Your Online Platform

Streamline your process of managing accounts payables and receivables with ease.

Explore the iPay Digital Method: The Seamless Solution for Secure Online Payments via ACH

Tired of intricate payment platforms that don't match your business needs? Say hello to iPay Digital, the straightforward answer for sending and receiving authenticated payments online through ACH.

- No accounts or app downloads necessary.

- Recipients never face fees.

- Instant verification of bank balances in real-time.

Instant Account Setup

Our streamlined online application process doesn't require any credit checks. Enjoy a simple application procedure and rapid eSign process, ensuring approval within minutes.

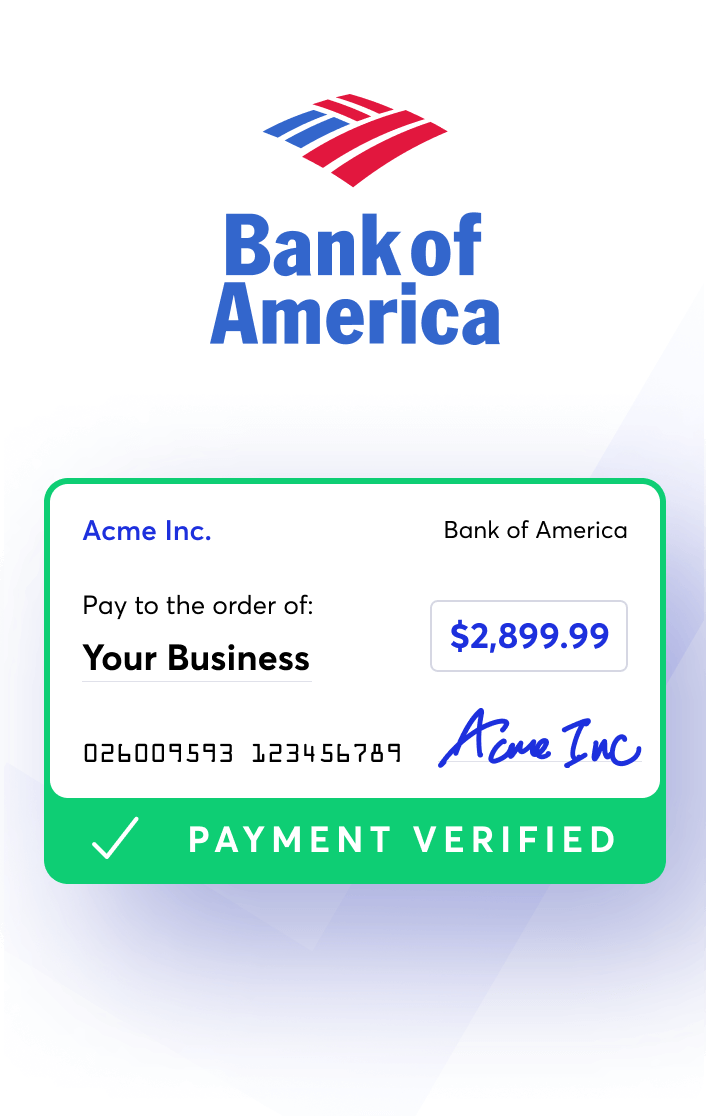

Instant Bank Verification

Eliminate the hassle of bounced checks and long waiting times.

Next-Day Transfers

Our cutting-edge security measures and optimized processing ensure that you can receive money online instantly in your bank account.

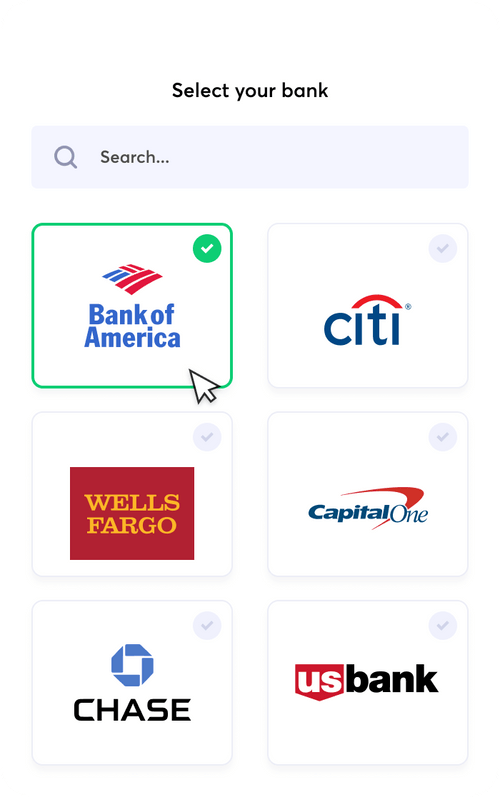

How to Accept Payments

The recipient selects their financial institution

The recipient enters online bank credentials

The recipient 's bank account is verified

Ways to Accept Payments

Core Features

Instant Bank Verification

Payment Links and Online Checkout

Recurring Billing

Store Payment Methods

Developer Friendly API

White Label Solutions

Empower Your Business

Streamlined Financial Solutions for Freelancers and Self-Employed Individuals

Efficiently dispatch invoices and online payments to clients or vendors without the need for credit checks or elaborate bank underwriting processes. Discover the convenience and cost-effectiveness of iPay Digital, providing budget-friendly pricing solutions designed to save you time and money.

Take your agency or small business to new heights with enhanced efficiency and streamlined processes.

Facilitate payments for clients, vendors, contractors, landlords, or any other stakeholders effortlessly. Utilize our state-of-the-art verification tools to ensure the availability of client funds prior to initiating payments. Simplify your financial management with iPay Digital's robust payment tracking system.

Streamline Your Client and Vendor Payments Seamlessly with iPay Digital

No account signup or app downloads needed.

Recipients won’t require an account or app to pay your invoice or receive a payment.

No sharing of bank information.

iPay Digital securely links to your bank account without the need to disclose sensitive account details.

100% free for the iPay Digital recipient.

Customers simply need to click the link provided in the email, connect to their bank account, and proceed with paying the invoice.

That’s it.

Acccept bill payments, disbursements, and invoicing

What Payment and Invoicing Options Does iPay Digital Offer?

Accept online payments swiftly, regardless of the method. Virtually any transaction typically managed by eCheck, credit card, or bank transfer can be effortlessly processed online using iPay Digital.

You’re in good company

Thousands of business owners trust iPay Digital to help them accept payments.

iPay Digital Merchant has been an invaluable asset to our organization, offering prompt responses and a delightful collaboration.

Their expertise in managing payment processing fees has been exceptional, keeping our costs to a minimum.

Thanks to iPay Digital Merchant's outstanding service and guidance, our ecommerce operations have become significantly more efficient.

Implementing eCheck verification has slashed returned checks for our clients by 63%, resulting in substantial savings on bank fees.

Reliable verification and responsive customer service make iPay Digital a trusted partner in our business operations.

The reduction in mailed checks, thanks to iPay Digital, has not only saved us money but also valuable time.

iPay Digital has streamlined our money collection process, making it faster, easier, and more efficient.

Exceptional service! iPay Digital's online payment system has significantly reduced accounts receivable by facilitating quick and secure transactions.

Addressing a crucial business need, iPay Digital has resolved our recurring payment challenges with vendors.

iPay Digital's user-friendly platform enables effortless one-time and recurring rent payments from our tenants.

Effortlessly receiving funds the next day from clients has become a seamless part of our business process, thanks to iPay Digital.

Every small business should embrace iPay Digital for quick, secure, and reliable payments.

iPay Digital has been a game-changer for our company, drastically reducing the time it takes to receive payments.

Transforming the Landscape of Payment Processing

Start accepting payments today with iPay Digital Merchant.

FAQ

To accept ACH payments online, follow these steps:

- Set Up an ACH Payment Processor: Choose a reliable ACH payment processor like iPay Digital that offers online ACH payment processing services.

- Create an Account: Sign up for an account with the ACH payment processor. Provide necessary details about your business and banking information.

- Integrate ACH Payment Gateway: Integrate the ACH payment gateway provided by the processor into your website or payment system. This allows customers to pay using their bank accounts.

- Display ACH Payment Option: Ensure that the ACH payment option is clearly visible on your website or checkout page along with other payment methods.

- Collect Authorization: Obtain authorization from customers to debit their bank accounts for payments. This can be done through a secure online form or by obtaining verbal authorization over the phone.

- Process ACH Payments: Once authorized, process the ACH payments through the integrated payment gateway. The funds will be transferred from the customer’s bank account to your business account electronically.

- Confirm Payment: Confirm the successful processing of ACH payments and provide customers with a receipt or confirmation of the transaction.

By following these steps, you can efficiently accept ACH payments online for your business.

Yes, generally, anyone with a valid bank account and access to an ACH payment processor can accept ACH payments. However, there are some considerations to keep in mind:

- Business Account: To accept ACH payments for business purposes, you typically need a business bank account. This allows you to receive payments directly into your business account.

- Agreement with Processor: You’ll need to establish an agreement with an ACH payment processor or a payment service provider that offers ACH processing services. This ensures that you have the necessary infrastructure to process ACH transactions.

- Compliance Requirements: Ensure that you comply with all legal and regulatory requirements related to ACH payments. This may include adhering to the rules and guidelines set forth by the National Automated Clearing House Association (NACHA) and other relevant authorities.

- Authorization from Customers: Before initiating ACH transactions, you must obtain authorization from your customers to debit their bank accounts for payments. This authorization is typically obtained through a signed agreement or an online authorization process.

- Security Measures: Implement robust security measures to protect sensitive customer information and ensure the secure transmission of ACH payment data.

By adhering to these guidelines and requirements, individuals and businesses can effectively accept ACH payments as a convenient and secure payment method.

Setting up ACH payments on your website involves several steps to ensure smooth and secure transactions:

- Choose an ACH Payment Processor: Research and select a reliable ACH payment processor or payment gateway provider that offers integration options suitable for your website platform.

- Integration: Integrate the chosen ACH payment solution with your website. This may involve installing plugins, integrating APIs, or incorporating payment buttons provided by the processor.

- Create Payment Pages: Design user-friendly payment pages where customers can enter their bank account details securely. Ensure that the payment pages comply with security standards and reflect your branding.

- Implement Security Measures: Implement robust security measures, such as SSL encryption and tokenization, to protect sensitive customer information during ACH transactions.

- Obtain Customer Authorization: Obtain explicit authorization from customers to debit their bank accounts for payments. This may involve implementing electronic signature solutions or providing clear consent forms.

- Testing: Test the ACH payment process thoroughly to ensure functionality and usability. Conduct test transactions to identify and resolve any issues before making the payment system live.

- Compliance: Ensure compliance with relevant regulations, such as those outlined by the National Automated Clearing House Association (NACHA) and other governing bodies, to avoid legal issues.

- Customer Support: Provide clear instructions and support channels for customers who may have questions or encounter issues during the ACH payment process.

By following these steps and working with a reputable payment processor, you can set up ACH payments on your website effectively, offering customers a convenient and secure payment option.

The cost of accepting ACH payments can vary depending on several factors, including the payment processor you choose, your business type, transaction volume, and the specific features or services you require. Here are some common cost considerations associated with accepting ACH payments:

- Transaction Fees: ACH transaction fees typically range from a few cents to a few dollars per transaction. Some processors may offer flat-rate pricing, while others may charge a percentage of the transaction amount.

- Monthly Fees: Some payment processors may require a monthly subscription or maintenance fee for access to their ACH processing services or additional features.

- Setup and Integration Fees: You may encounter one-time setup or integration fees when initially setting up your ACH payment system or integrating it with your website or business software.

- Return and NSF Fees: If ACH transactions are returned due to insufficient funds or other issues, you may incur return or non-sufficient funds (NSF) fees from your payment processor.

- Volume Discounts: Some processors offer volume discounts or tiered pricing based on your monthly transaction volume. Higher transaction volumes may result in lower per-transaction fees.

- Additional Features: Certain features or services, such as advanced reporting, fraud prevention tools, or customer support options, may come with additional fees.

It’s essential to carefully review the fee structure and terms of service provided by potential ACH payment processors to understand the total cost of accepting ACH payments for your business. Additionally, consider factors such as reliability, security, and customer support when selecting a payment processor to ensure that you receive value for your investment.

ACH (Automated Clearing House) payments and EFT (Electronic Funds Transfer) payments are both electronic methods of transferring funds between bank accounts, but there are some key differences between the two:

Definition:

- ACH Payment: ACH payments specifically refer to transactions processed through the Automated Clearing House network, which is a secure electronic network used for financial transactions in the United States.

- EFT Payment: Electronic Funds Transfer (EFT) is a broader term that encompasses various methods of transferring funds electronically, including ACH payments, wire transfers, and other electronic payment methods.

Processing Time:

- ACH Payment: ACH payments typically take 1-3 business days to process and settle.

- EFT Payment: EFT payments can vary in processing time depending on the specific method used. Some EFT methods, such as wire transfers, may offer same-day or next-day processing, while others may take longer.

Cost:

- ACH Payment: ACH payments are generally more cost-effective than other forms of electronic payments, such as wire transfers, making them suitable for recurring payments and transactions with lower processing fees.

- EFT Payment: The cost of EFT payments can vary depending on the specific method used and the financial institutions involved. Wire transfers, for example, often incur higher fees compared to ACH payments.

Use Cases:

- ACH Payment: ACH payments are commonly used for various purposes, including direct deposit of payroll, bill payments, vendor payments, and electronic check payments.

- EFT Payment: EFT payments encompass a broader range of electronic payment methods and can include transactions such as wire transfers, online bill payments, and electronic check conversions.

While ACH payments are a specific type of EFT payment processed through the ACH network, EFT payments encompass a wider range of electronic payment methods beyond ACH transactions. Both ACH payments and EFT payments offer convenient and efficient ways to transfer funds electronically, with differences in processing time, cost, and use cases.

- Bank Statement ($5,000)

- Driver ‘s License

- Articles of Incorporation

- Employer Identification Number (EIN)