The world of finance and payment processing can often seem daunting, especially when terms like eCheck, ACH, and merchant accounts come into play. Yet, these processes are increasingly becoming the backbone of many businesses, including e-commerce. While it may sound complex, eCheck payment processing is a concept even a 5th grader could grasp. Let’s dive into the world of eCheck payments and see just how straightforward, smart, and beneficial they can be for your business.

What Is eCheck Payment Processing?

eCheck, short for electronic check, is a digital version of a paper check. When customers use eCheck to pay for goods or services, they’re essentially authorizing a digital transaction that pulls funds directly from their bank account and deposits them into the recipient’s account. This process mimics the traditional check writing process but leverages modern technology to facilitate the transfer.

How Does eCheck Payment Processing Work?

Here’s a simplified breakdown of how eCheck payments work, keeping in mind the kind of explanation a 5th grader might understand:

- Authorization: The customer provides their bank account information and authorizes the transaction.

- Initiation: The payment processor begins the transaction process by submitting the request to the Automated Clearing House (ACH) network.

- Verification: The customer’s bank account details are verified to ensure that there are sufficient funds and that the account is valid.

- Clearing: Once verified, the transaction is processed through the ACH network.

- Settlement: The funds are transferred from the customer’s bank account to the recipient’s bank account.

- Notification: Both parties receive confirmation of the transaction’s success.

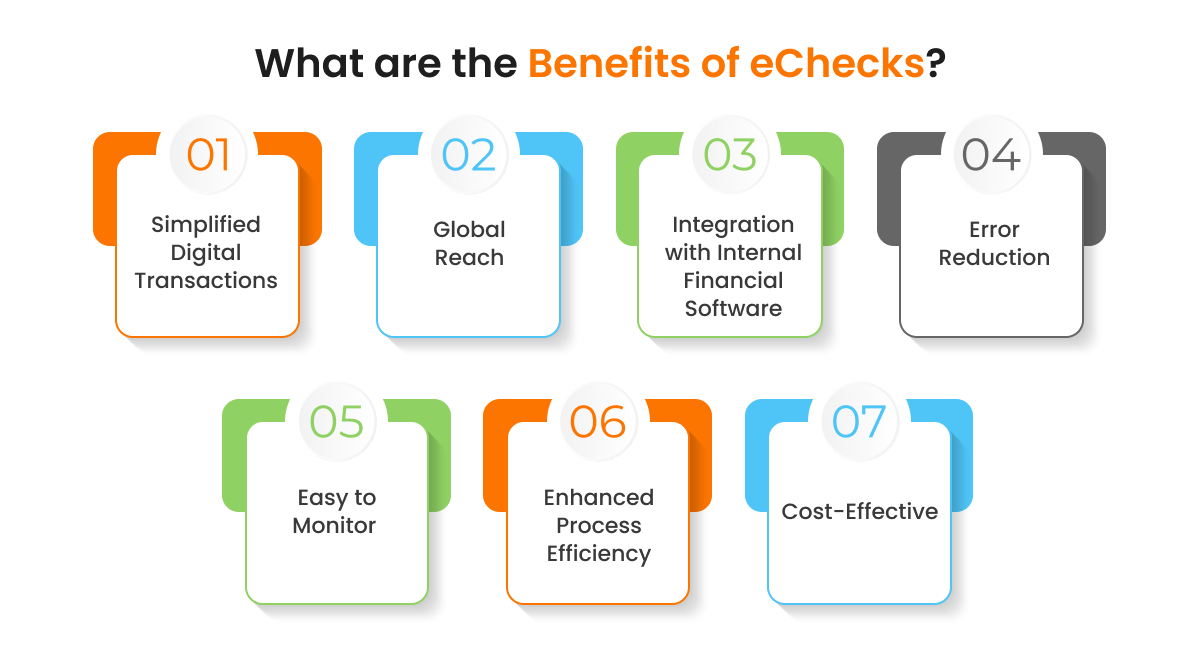

Benefits of eCheck Payment Processing

eCheck payment processing offers a range of benefits that make it a smart choice for businesses looking to optimize their payment systems:

- Cost-Effective: Processing eChecks is generally less expensive than credit card transactions. This can lead to significant savings, especially for businesses with high transaction volumes.

- Security: eCheck transactions are processed through the ACH network, which employs advanced security measures to protect sensitive financial information.

- Convenience: Customers can easily authorize payments online or over the phone, providing a seamless payment experience.

- Faster Processing: While traditional checks may take days to clear, eChecks can process in a much shorter time frame, improving cash flow for businesses.

- Compliance and Record-Keeping: eChecks offer a digital paper trail that can be tracked and monitored for compliance and financial record-keeping.

- Flexibility: Businesses can set up eCheck payments for one-time transactions or recurring billing, depending on their needs.

How Can eCheck Benefit Your Business?

Now that we’ve explored the basics of eCheck payment processing, let’s discuss how it can benefit your business:

- Enhanced Customer Experience: By offering eCheck as a payment option, you give your customers the flexibility to choose their preferred payment method, improving overall satisfaction.

- Improved Cash Flow: Faster processing times mean funds are available sooner, helping maintain a healthy cash flow.

- Reduced Costs: Lower processing fees translate to cost savings, which can be reinvested in other areas of your business.

- Increased Sales: Offering multiple payment options, including eCheck, can attract a broader customer base and encourage more sales.

How to Choose the Right eCheck Payment Processing Service

Choosing the right eCheck payment processing service is crucial for maximizing the benefits of this payment method. Here are a few key factors to consider:

- Reputation: Choose a provider with a solid reputation and positive reviews from other businesses.

- Security: Ensure the provider employs advanced security measures to protect your and your customers’ financial information.

- Integration: Look for a service that integrates seamlessly with your existing systems, such as your e-commerce platform or accounting software.

- Customer Support: Opt for a provider that offers reliable customer support in case you encounter any issues.

- Pricing: Compare pricing models to find a service that offers competitive rates and aligns with your budget.

Conclusion

While eCheck payment processing may seem complex at first glance, its benefits for businesses are clear. With cost-effective transactions, enhanced security, and improved convenience for customers, eChecks are an excellent choice for businesses looking to optimize their payment systems.

By choosing a reputable and secure eCheck payment processing service, you can leverage this technology to enhance your business’s financial operations. So, is your eCheck payment processing service smarter than a 5th grader? If it’s not, now is the time to take the necessary steps to level up your payment system and experience the advantages of eCheck payments.