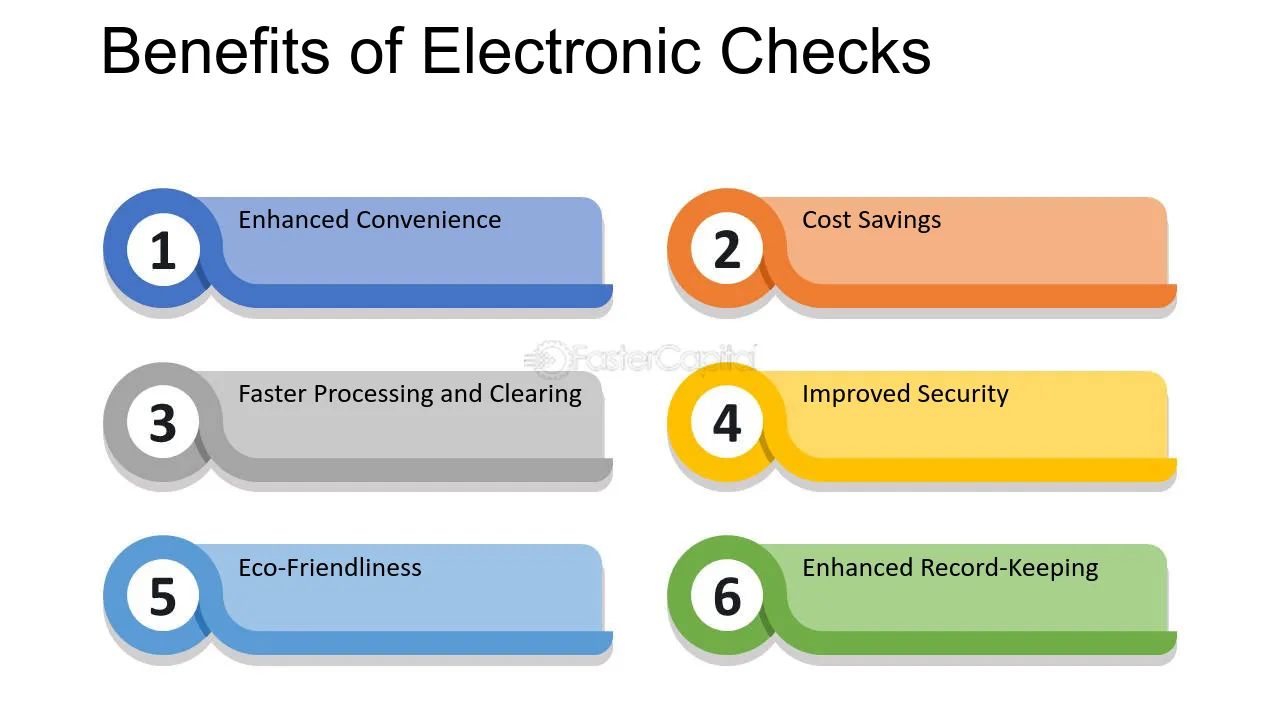

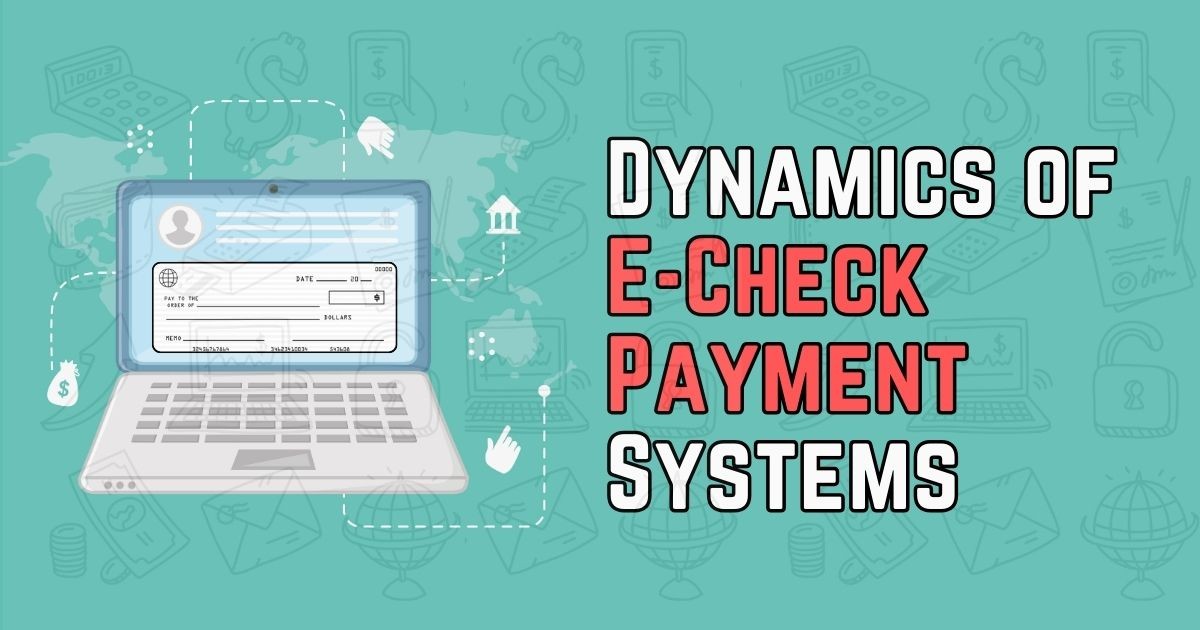

Setting up eCheck payment processing for your business can offer numerous benefits, including lower transaction fees, a secure and efficient method of payment, and a broader customer base. eCheck payment processing allows you to receive payments electronically, which can help streamline your business operations and improve your cash flow. In this blog, we’ll walk you through the steps to set up eCheck payment processing for your business and provide tips on how to optimize the process for your customers.

Step 1: Choose an eCheck Payment Processor

The first step in setting up eCheck payment processing for your business is choosing a reliable payment processor. There are many payment processors on the market, each offering different features and fees. Look for a processor that provides the following:

- Security: Ensure that the processor offers secure encryption and fraud protection to protect your business and customers’ sensitive information.

- Integration: Choose a processor that integrates seamlessly with your existing business systems, such as your point-of-sale (POS) system or e-commerce platform.

- Customer Support: Opt for a processor that provides excellent customer support to assist you in case of any issues or questions.

- Competitive Fees: Compare the fees of different processors to find one that offers competitive rates for eCheck transactions.

Step 2: Apply for an eCheck Merchant Account

Once you’ve chosen a payment processor, the next step is to apply for an eCheck merchant account. This account allows you to accept eCheck payments from your customers. The application process typically involves providing information about your business, such as:

- Business name and address

- Tax identification number

- Business bank account information

- Business history and industry type

After submitting your application, the payment processor will review your information and approve your merchant account. This process can take a few days, so be sure to apply in advance of when you plan to start accepting eCheck payments.

Step 3: Integrate eCheck Payment Processing

Once your eCheck merchant account is approved, you’ll need to integrate eCheck payment processing into your business systems. This may involve working with your payment processor to add eCheck payment options to your POS system, e-commerce website, or billing software.

- POS Integration: If you have a brick-and-mortar store, work with your payment processor to enable eCheck payments at your POS system. This may involve installing software or updating your existing hardware.

- E-commerce Integration: For online businesses, integrate eCheck payment options into your checkout process. This can usually be done through your e-commerce platform or a plugin provided by your payment processor.

- Billing Software Integration: If you use billing software for invoicing customers, make sure eCheck payment options are available when you send invoices.

Step 4: Train Your Staff and Educate Your Customers

Once your eCheck payment processing system is set up, it’s important to train your staff on how to use the new payment method and educate your customers about the benefits of eCheck payments.

- Staff Training: Ensure your employees understand how to process eCheck payments and handle any issues that may arise. Provide them with clear instructions and support resources.

- Customer Education: Inform your customers about the availability of eCheck payments and how to use them. Highlight the benefits, such as convenience, security, and lower fees, to encourage them to use this payment method.

Tips for Optimizing eCheck Payment Processing

Here are some additional tips to help you optimize eCheck payment processing for your business:

- Offer Incentives: Encourage customers to use eCheck payments by offering incentives, such as discounts or rewards points.

- Automate Recurring Payments: If you offer subscription services or recurring billing, automate eCheck payments to streamline the process for your customers and your business.

- Monitor and Analyze Transactions: Regularly monitor and analyze your eCheck transactions to identify trends and areas for improvement. Use this data to make informed decisions about your payment processing strategy.

- Keep Security a Priority: Continuously evaluate the security measures in place for eCheck payment processing to ensure your business and customer data remain safe.

Conclusion

Setting up eCheck payment processing for your business can provide a range of benefits, including lower fees, increased efficiency, and enhanced customer satisfaction. By choosing the right payment processor, integrating eCheck payment options into your systems, and educating your staff and customers, you can optimize the process for your business. Keep security a priority and continuously monitor your transactions to make the most of this modern payment method. By following these steps and tips, you can revolutionize your payment processing and take your business to the next level.