In today’s digital world, financial services are constantly evolving to meet the needs of consumers and businesses. Credit repair is one such industry where new and innovative payment solutions are playing a significant role. Among them, eCheck payment solutions have emerged as a game-changer for credit repair businesses. By streamlining payment processes and offering convenience to both clients and businesses, eCheck payments have transformed the way credit repair services operate.

In this blog, we will explore how eCheck payment solutions benefit credit repair businesses, discuss how they work, and offer insights on why these solutions are gaining popularity among credit repair service providers.

What is eCheck Payment Processing?

eCheck payment processing is a secure, electronic method of processing payments using bank account information instead of traditional credit or debit card information. When a client opts for an eCheck payment, the funds are transferred directly from their bank account to the credit repair business’s account.

How Do eCheck Payments Work?

- Authorization: The client provides their bank account information (account number and routing number) to the credit repair business. This information is typically collected electronically through a secure online form.

- Initiation: Once the client authorizes the payment, the credit repair business initiates the eCheck payment transaction.

- Verification: The payment processor verifies the client’s bank account information and ensures sufficient funds are available for the transaction.

- Transfer: If the verification is successful, the payment processor transfers the funds from the client’s bank account to the credit repair business’s bank account.

- Confirmation: The credit repair business receives a confirmation of the payment, and the client’s bank account is debited.

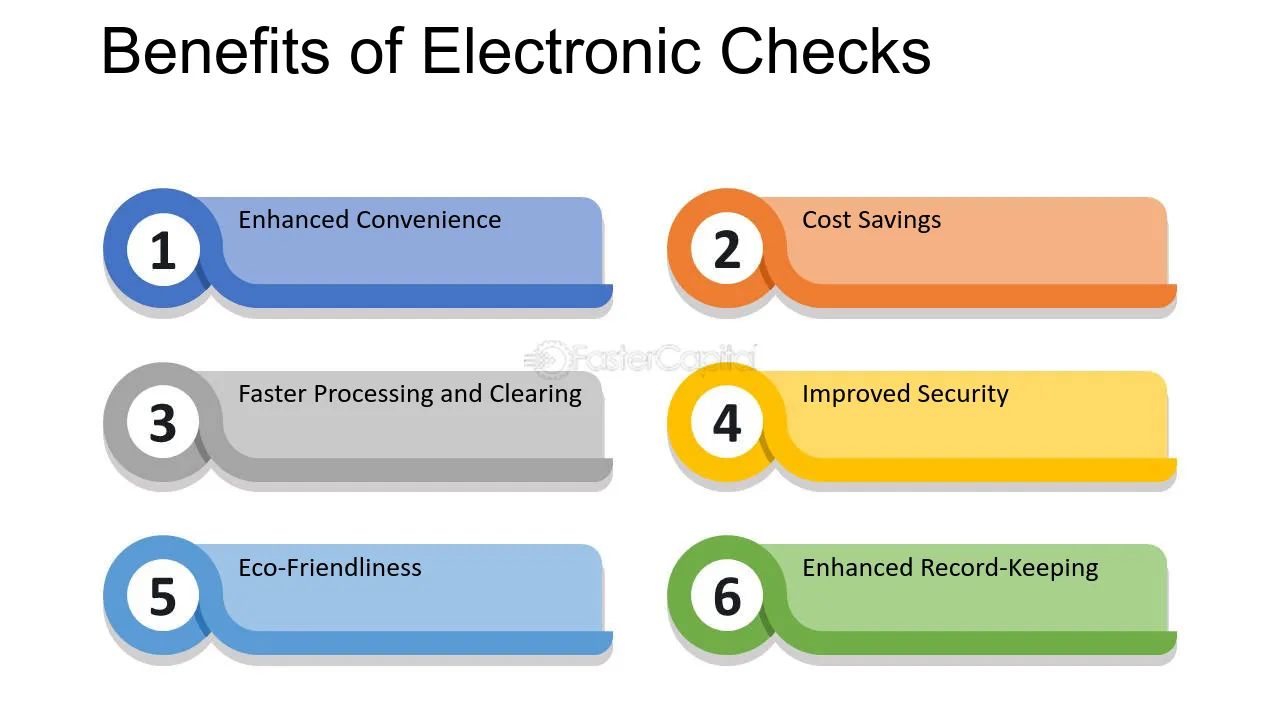

Benefits of eCheck Payment Solutions for Credit Repair Businesses

- Cost-Effective: eCheck payments often come with lower transaction fees compared to credit and debit card payments. This cost-saving advantage helps credit repair businesses manage their finances more efficiently.

- Security: eCheck payment processing is highly secure and encrypted, providing peace of mind to both clients and businesses. This security reduces the risk of fraud and chargebacks.

- Convenience: eCheck payments offer clients a simple and convenient way to pay for credit repair services. Clients can authorize payments online, eliminating the need for physical checks or in-person transactions.

- Recurring Payments: Credit repair services often require ongoing support, making recurring payments essential. eCheck payments facilitate easy setup of recurring payments, ensuring steady revenue for credit repair businesses.

- Streamlined Operations: By automating payment processing, eCheck solutions save time and reduce administrative burdens for credit repair businesses. This allows them to focus on their core services and improve client relationships.

- Wider Reach: eCheck payments enable credit repair businesses to cater to clients who may not have credit cards or prefer not to use them. This inclusivity can expand the customer base and increase business opportunities.

How to Implement eCheck Payment Solutions for Credit Repair

- Choose a Reliable Payment Processor: To offer eCheck payment solutions, partner with a reputable payment processor that specializes in eCheck and ACH payment processing. Look for a provider that offers secure, efficient, and user-friendly services.

- Secure Client Authorization: Obtain explicit authorization from clients to process eCheck payments. This can be done through an electronic agreement or signed consent form, ensuring compliance with legal and regulatory requirements.

- Automate Recurring Payments: Set up automated recurring payments for clients who require ongoing credit repair services. This streamlines the payment process and ensures consistent cash flow.

- Educate Clients: Inform clients about the benefits and security of eCheck payments. Address any concerns they may have and provide clear instructions on how to authorize payments.

- Monitor Transactions: Keep track of eCheck transactions to ensure accuracy and timeliness. Address any issues promptly to maintain client trust and satisfaction.

Conclusion

eCheck payment solutions are transforming the credit repair industry by offering a secure, efficient, and cost-effective method of processing payments. By implementing eCheck payments, credit repair businesses can streamline operations, reduce costs, and enhance the client experience.

As the demand for credit repair services continues to grow, businesses that embrace eCheck payment solutions will be better positioned to thrive in the competitive market. By providing clients with a convenient and secure payment option, credit repair businesses can elevate their services and drive long-term success.