In the dynamic landscape of financial technology, the quest for enhanced security and user-friendly experiences is ever-evolving. As we navigate the digital realm, one aspect gaining significant traction is the integration of biometrics into eCheck payments. This blog delves into the revolutionary impact of biometrics and explores how it’s transforming user authentication, making eCheck payments not only more secure but also seamlessly convenient.

The Biometric Revolution:

Traditional authentication methods, such as passwords and PINs, are susceptible to breaches, leading to an increased demand for more robust and user-centric solutions. Biometrics, encompassing unique physical or behavioral attributes, offers a cutting-edge approach to identity verification. In the context of eCheck payments, this paradigm shift is reshaping the landscape of transaction security.

Biometrics in eCheck Payments: A Symbiotic Alliance:

1. Fingerprint Recognition:

How it Works: Users authenticate payments by placing their finger on a biometric sensor.

Advantages: Uniqueness of fingerprints ensures a highly secure authentication process.

2. Facial Recognition:

How it Works: Users’ faces are scanned and matched against pre-stored facial data for authentication.

Advantages: Enhances user experience by providing a seamless and contactless authentication method.

3. Voice Recognition:

How it Works: Users’ voices are analyzed for unique vocal characteristics.

Advantages: Offers a natural and non-intrusive authentication method, promoting accessibility.

4. Iris Scanning:

How it Works: Iris patterns are captured and used for authentication.

Advantages: High accuracy and resistance to forgery make it a secure biometric method.

Revolutionizing User Authentication:

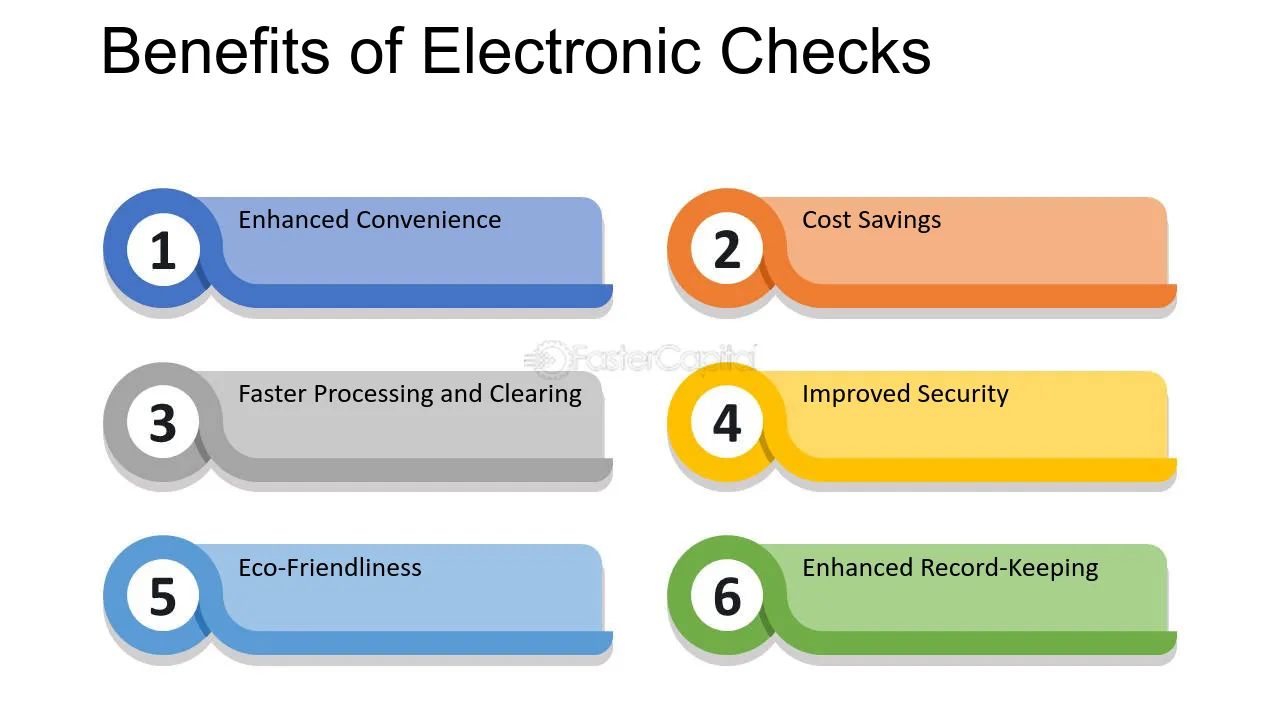

1. Enhanced Security:

Biometric authentication adds an extra layer of security, reducing the risk of unauthorized access and identity theft. The uniqueness of biometric markers ensures a more robust defense against fraudulent activities.

2. Frictionless User Experience:

Traditional authentication methods often lead to user frustration due to forgotten passwords or PINs. Biometrics offer a seamless and user-friendly experience, eliminating the need for memorization and manual input.

3. Reduced Fraud and Impersonation:

The use of biometrics significantly minimizes the risk of fraud and impersonation. With features like facial recognition and fingerprint scanning, eCheck payments become inherently more secure.

4. Accessibility and Inclusivity:

Biometric authentication methods cater to diverse user needs. They are particularly advantageous for individuals with disabilities, offering an inclusive approach to user authentication.

5. Streamlined Transactions:

The speed and accuracy of biometric authentication contribute to faster transaction processes. This efficiency is crucial in the context of eCheck payments, where a seamless user experience is paramount.

Implementing Biometric Authentication in eCheck Payments:

1. Integration with Secure Platforms:

Collaborate with payment gateways and platforms that support biometric authentication, ensuring a secure and compliant environment.

2. User Education and Consent:

Transparently communicate the use of biometrics in eCheck payments to users. Obtain explicit consent to build trust and compliance.

3. Continuous Technological Advancements:

Stay abreast of emerging technologies in biometrics to leverage the latest and most secure authentication methods.

Looking Ahead: A Biometrically Secured Future:

As technology continues to advance, the synergy between biometrics and eCheck payments will play a pivotal role in shaping the future of secure and user-centric transactions. The evolution of biometric authentication represents a stride towards a more interconnected, secure, and inclusive financial landscape, where users can engage in digital transactions with confidence and convenience. Embrace the biometric revolution in eCheck payments to unlock a new era of authentication that goes beyond traditional boundaries.