In recent years, contactless payments have seen explosive growth, with businesses across the U.S. adapting to this new trend. The demand for quick, secure, and convenient payment options is soaring, and for good reason. The rise in contactless payment methods has been driven by several factors, including consumer preference for faster transactions, advancements in technology, and safety concerns, especially in the wake of the COVID-19 pandemic. According to a report by Statista, the global market for contactless payments is expected to surpass $16.59 trillion by 2028. This surge isn’t just a passing trend—it’s the future of payment processing.

For U.S. merchants, this shift is crucial to remaining competitive. From tap-and-go cards to mobile wallets and QR codes, businesses are embracing contactless solutions to meet consumer demands. But what’s fueling this growth, and which payment methods are leading the charge?

The Growing Popularity of Contactless Payments

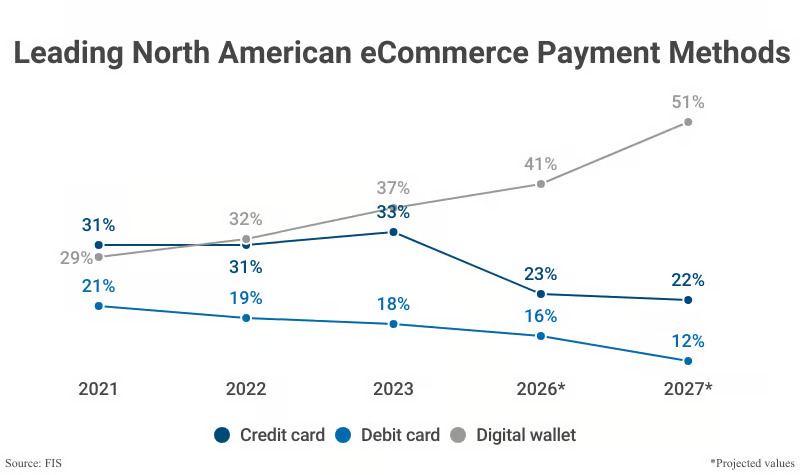

Before diving into the various methods of contactless payments, it’s essential to understand why they’re becoming so popular. In the U.S., contactless payments have grown at an astonishing rate. In 2021, 29% of all in-person card payments were contactless, a sharp increase from previous years. This growth is driven not only by the pandemic but by the convenience and speed these payments offer. According to another report from Statista, by 2023, mobile payments are expected to account for 25% of all eCommerce transactions in the U.S.

Different Types of Contactless Payment Methods

1. Tap-and-Go Credit and Debit Cards

One of the most familiar contactless payment methods is tap-and-go credit and debit cards. These cards come equipped with Near Field Communication (NFC) technology, allowing users to pay by simply tapping their card on a payment terminal. It’s a fast, convenient option that’s growing in popularity across the U.S.

In fact, Visa reported that, in 2020 alone, more than 300 million contactless cards were issued in the U.S. Tap-and-go cards help reduce transaction times, improve customer satisfaction, and ensure security through tokenization, which protects the sensitive data transmitted during transactions.

2. Mobile Wallets (Apple Pay, Google Pay, Samsung Pay)

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay are also contributing to the contactless payment revolution. These digital wallets allow users to store their credit and debit card information on their smartphones or wearable devices, making payments with a simple tap at the terminal.

Statista reports that the number of mobile wallet users in the U.S. is expected to surpass 100 million by 2024. The security benefits of mobile wallets are another reason for their popularity—transactions are often authenticated using biometric data such as a fingerprint or facial recognition, which provides an added layer of security.

3. QR Code Payments

QR code payments are another form of contactless transaction that has gained traction, especially in retail and dining. Merchants simply display a QR code at checkout, and customers scan it using their smartphone to complete the payment. This method is not only convenient but also accessible, as it requires no specialized hardware for the merchant.

In 2022, more than 11 million U.S. households used QR code payments regularly. It’s an easy-to-implement solution for businesses looking to offer contactless options without making significant infrastructure investments.

4. eCheck Payments

While not typically associated with contactless transactions, eCheck payments are making a comeback, particularly for large-scale transactions or recurring payments. An eCheck allows a merchant to electronically withdraw funds from a customer’s bank account, similar to a traditional paper check, but faster and more secure.

This method is especially valuable for industries like healthcare, insurance, and utilities, where customers regularly make high-value or recurring payments. Nacha, the governing body of the Automated Clearing House (ACH), reported a 15% increase in eCheck transactions in 2021.

5. Wearable Payment Devices

Wearable payment devices, like smartwatches and fitness trackers, are becoming more common as consumers look for even more convenient ways to make contactless payments. Devices such as the Apple Watch or Fitbit allow users to store payment information directly on their wrist. With a simple tap, they can pay for products and services without the need to carry a card or smartphone.

While still an emerging technology, Statista projects that wearable payment devices could represent over 10% of the contactless payment market by 2025. For businesses, embracing this technology is essential to staying ahead of the curve.

The Benefits of Contactless Payments for U.S. Merchants

For U.S. merchants, the benefits of adopting contactless payment systems are clear. Here’s why integrating these payment options is crucial for business growth:

- Faster Transactions: Contactless payments significantly reduce the time it takes to complete a transaction. On average, a tap-and-go payment is completed in under 10 seconds, compared to 30 seconds or more for a traditional chip card.

- Enhanced Security: Contactless payments provide an extra layer of security for both consumers and businesses. By using tokenization and encryption, sensitive information is kept safe from fraudsters. Mobile wallets, for example, don’t store actual card numbers but instead use encrypted tokens that cannot be duplicated.

- Health and Safety: In a post-pandemic world, minimizing physical contact during transactions has become a priority. Contactless payments allow for a completely touch-free experience, ensuring both customers and employees can avoid unnecessary contact with surfaces like card readers or cash.

- Increased Customer Satisfaction: Quick and seamless transactions enhance the overall customer experience. Consumers are more likely to return to businesses that offer a smooth, hassle-free checkout process.

- Catering to Consumer Preferences: As contactless payments become the norm, businesses that fail to adopt these systems risk alienating customers who prefer touchless payment methods. In 2022, 56% of consumers said they preferred businesses that offered contactless payments, up from 37% in 2019.

Why Contactless Payments Are the Future

The rise in contactless payments isn’t just a temporary trend—it’s here to stay. The convenience, security, and speed offered by these methods make them a preferred choice for consumers. As Statista reports, more than 70% of transactions in the U.S. will be contactless by 2025, making it essential for merchants to adopt these systems to stay competitive.

Additionally, the growing popularity of mobile wallets and wearable devices shows that the payment landscape is continuing to evolve. For businesses, adopting these payment methods is not only about providing convenience but also about future-proofing their operations in an increasingly digital world.

The Role of Merchant Services

Merchant services play a crucial role in enabling businesses to accept contactless payments. Whether it’s setting up an ACH account, integrating mobile wallet systems, or offering eCheck payments, merchant service providers offer the necessary infrastructure for handling a variety of transactions. By partnering with a reliable merchant service provider, businesses can streamline payment processes, improve security, and boost customer satisfaction.

Conclusion: A Surge in the Right Direction

The surge in contactless payments in the U.S. marks a significant shift in how businesses and consumers handle transactions. With options like tap-and-go cards, mobile wallets, QR codes, and eChecks, merchants have more opportunities than ever to provide fast, secure, and convenient payment experiences.

As consumer preferences continue to evolve and mobile traffic for websites surges—statista reports that over 58% of all web traffic now comes from mobile devices—businesses must keep pace by offering the latest in payment technology. For U.S. merchants, the future is contactless, and those who embrace this shift will be well-positioned for success in the years to come.