In the digital age, financial transactions are evolving rapidly. One of the significant advancements in this domain is the introduction of digital checks. But what exactly is a digital check, and how can it replace traditional paper checks? This blog delves into the concept of digital checks, their benefits, and the steps to transition from paper checks to digital payments.

Understanding Digital Checks

A digital check, also known as an electronic check or eCheck, is an electronic version of a traditional paper check. It is used to transfer funds from one bank account to another via the internet. Just like a paper check, a digital check contains information such as the payer’s bank account number, the payee’s details, the check amount, and the date. However, instead of writing this information on paper, it is entered into an electronic format and transmitted through secure channels.

Is There a Difference Between a Digital Check and an eCheck?

While the terms “digital check” and “eCheck” are often used interchangeably, there can be subtle differences between the two:

- Digital Check: A broad term that refers to any check that is issued, transmitted, and processed electronically. Digital checks encompass various electronic payment methods and may include additional features such as enhanced security protocols or integration with digital wallets and financial management systems.

- eCheck: Specifically refers to a digital payment processed through the Automated Clearing House (ACH) network. eChecks use the same information found on a paper check—such as the bank account number and routing number—but transmit this information electronically for ACH processing. They are often used for direct debits, bill payments, and other transactions where funds are transferred directly between bank accounts.

Problems with Using Paper Checks

Paper checks have been a staple of financial transactions for decades, but they come with several drawbacks:

- Processing Time: Paper checks can take several days to clear, delaying the availability of funds.

- Manual Handling: Issuing, mailing, and processing paper checks require manual effort, increasing the potential for human error.

- Security Risks: Paper checks can be lost, stolen, or altered, leading to potential fraud and financial loss.

- Cost: Printing, mailing, and handling paper checks incur costs for businesses and individuals.

- Environmental Impact: The use of paper checks contributes to environmental degradation through paper consumption and waste.

Benefits of Transitioning from Paper to eCheck Digital Payments

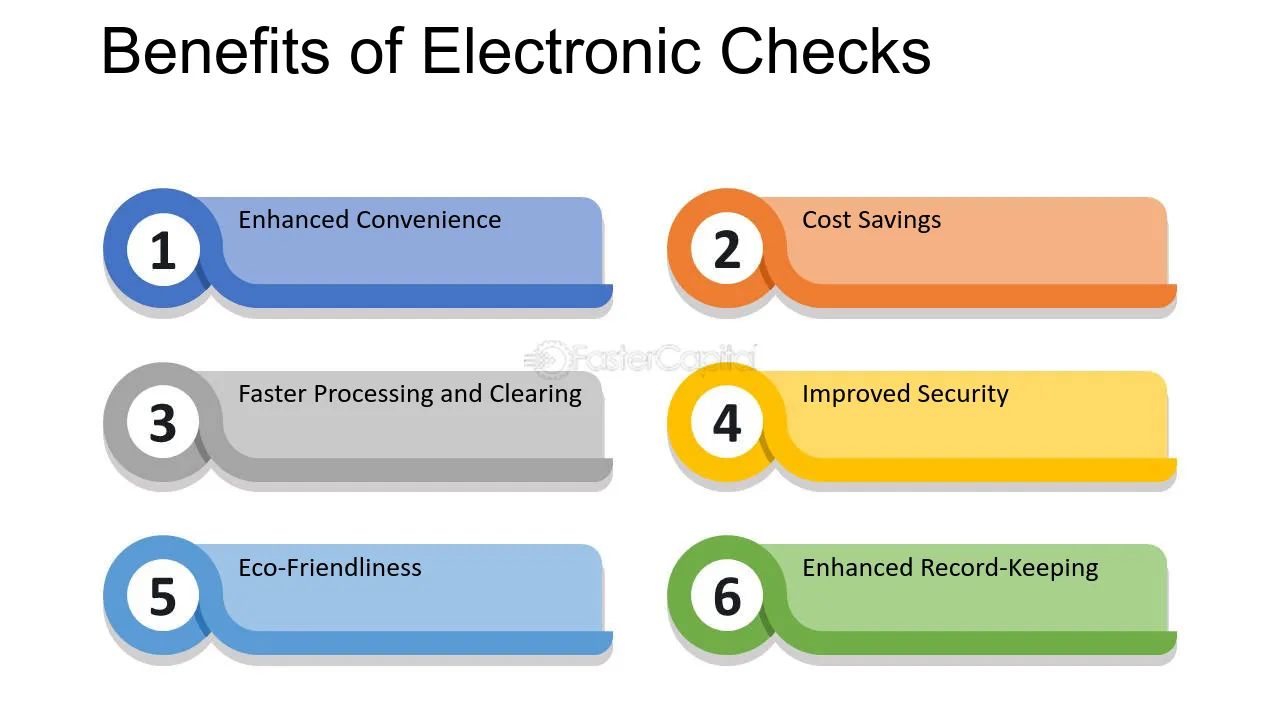

Switching to digital checks offers numerous advantages over traditional paper checks:

1. Convenience

Digital checks can be issued and processed from anywhere with an internet connection, eliminating the need for physical transportation of checks. This convenience is particularly beneficial for businesses with remote operations or international transactions.

2. Speed

Unlike paper checks, which can take several days to clear, digital checks are processed much faster. This quick processing reduces the time taken for funds to be available in the payee’s account, improving cash flow for businesses and individuals.

3. Cost-Effective

Using digital checks can significantly reduce costs associated with printing, mailing, and handling paper checks. This cost-effectiveness is especially advantageous for businesses that issue a large number of checks.

4. Security

Digital checks are encrypted and transmitted through secure networks, minimizing the risk of theft, fraud, and loss. Additionally, the digital trail left by these transactions makes it easier to track and verify payments.

5. Environmental Impact

By eliminating the need for paper, digital checks contribute to environmental conservation. This reduction in paper usage aligns with the growing emphasis on sustainable business practices.

6. Integration with Financial Systems

Digital checks can be easily integrated with accounting and financial management systems, streamlining the reconciliation process and providing real-time updates on transaction statuses.

So, Why Do So Many Businesses Still Use Paper Checks?

Despite the clear advantages of digital checks, many businesses continue to use paper checks due to several reasons:

- Habit and Tradition: Businesses often stick to familiar processes and are slow to adopt new technologies.

- Lack of Awareness: Some businesses may not be fully aware of the benefits and security of digital checks.

- Infrastructure and Integration: Transitioning to digital checks may require changes to existing accounting and financial systems, which can be daunting.

- Customer Preference: Some clients and vendors may prefer paper checks due to their familiarity and ease of use.

- Regulatory and Compliance Issues: Certain industries may face regulatory requirements that make transitioning to digital checks more complex.

Making the Transition: What Are the Paper Check Alternatives?

For businesses looking to transition from paper checks to more efficient payment methods, several alternatives are available:

1. eChecks

As previously discussed, eChecks are a direct replacement for paper checks and are processed through the ACH network. They offer a seamless transition with the same essential functionality as paper checks but with enhanced speed and security.

2. Direct Deposit

Direct deposit is a method where funds are electronically transferred directly into a bank account. It is commonly used for payroll and vendor payments, offering convenience and immediate access to funds.

3. Online Bill Pay

Many banks and financial institutions offer online bill pay services, allowing businesses to pay invoices and bills electronically. This method is efficient and reduces the need for manual check writing.

4. Credit and Debit Cards

For routine business transactions, using credit or debit cards can be a convenient and secure alternative to checks. Many vendors and service providers accept card payments.

5. Digital Wallets

Digital wallets such as PayPal, Apple Pay, and Google Wallet provide secure and efficient ways to make and receive payments electronically. They are especially useful for small businesses and online transactions.

6. Automated Clearing House (ACH) Transfers

ACH transfers allow businesses to send and receive payments electronically through the ACH network. They are ideal for recurring payments and can significantly reduce transaction processing times.

Conclusion

Digital checks represent a significant step forward in the evolution of financial transactions. With their numerous benefits, including convenience, speed, cost-effectiveness, and security, they have the potential to replace traditional paper checks entirely. Understanding the differences between digital checks and eChecks, the problems with paper checks, and the benefits of digital payments can help businesses and individuals make informed decisions.

As technology continues to advance and consumer preferences shift towards digital payment processing solutions, the adoption of digital checks is likely to become even more widespread. Embracing this innovation can lead to more efficient, secure, and sustainable financial transactions for everyone. By exploring the available alternatives and making the transition from paper checks, businesses can stay ahead of the curve and enjoy the many advantages of digital payments.