With this era of digital commerce, businesses continuously seek methods to enhance transaction efficiency, reduce costs, and improve customer experience. One technology that has gained significant traction in recent years is Automated Clearing House (ACH) Interactive Voice Response (IVR) payments. ACH IVR payment providers offer a unique solution that combines the reliability of ACH transactions with the convenience of IVR systems, thereby elevating transaction efficiency for businesses. This blog delves into the concept of ACH IVR payments, explores their benefits, and highlights how businesses can leverage this technology to streamline their payment processes.

Understanding ACH IVR Payments

ACH payments are electronic transactions that facilitate the transfer of funds between bank accounts within the United States. Managed by the National Automated Clearing House Association (NACHA), the ACH network processes billions of transactions annually, including direct deposits, bill payments, and business-to-business payments. ACH payments are known for their cost-effectiveness, security, and reliability, making them a preferred choice for businesses.

IVR Systems:

IVR systems are automated telephony solutions that interact with callers, gather information, and route calls to the appropriate recipients. They use pre-recorded voice prompts and touch-tone inputs to guide users through various tasks, such as making payments, checking account balances, and accessing customer support. IVR systems are widely used in customer service and payment processing due to their efficiency and ease of use.

ACH IVR Payments:

ACH IVR payments merge the capabilities of ACH transactions with IVR systems, allowing customers to make secure payments over the phone. When a customer initiates a payment call, the IVR system guides them through the payment process, collects necessary information, and processes the transaction via the ACH network. This seamless integration offers a convenient and efficient payment solution for both businesses and customers.

Benefits of ACH IVR Payments

1. Enhanced Transaction Efficiency:

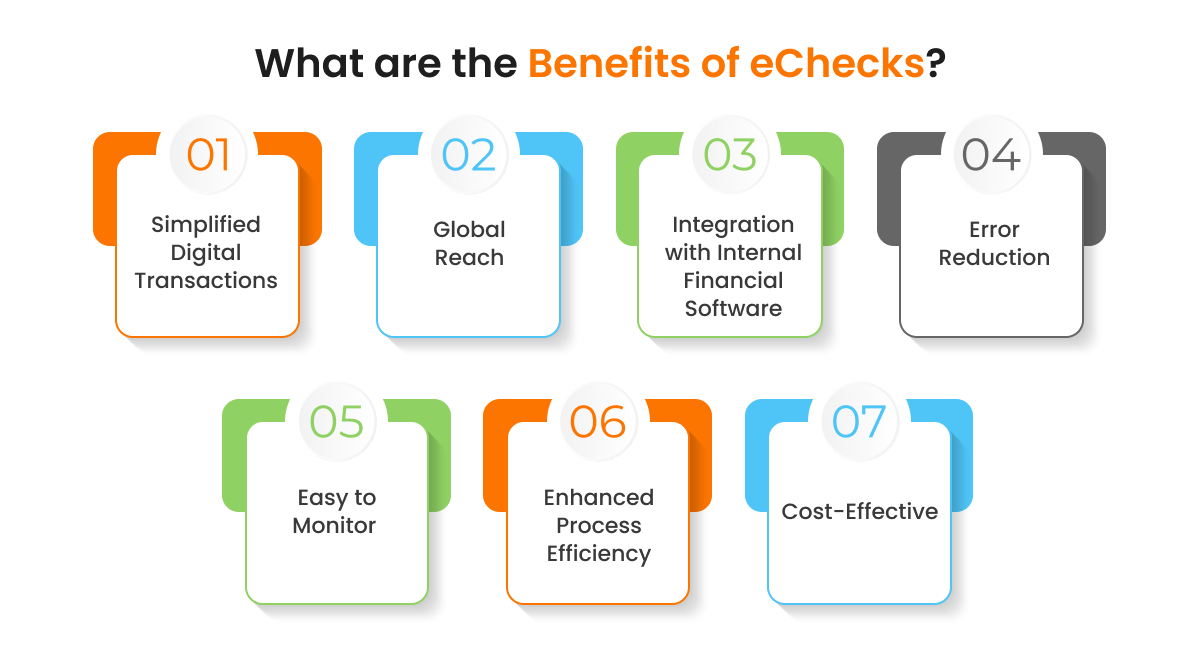

ACH IVR payments significantly improve transaction efficiency by automating the payment process. Customers can make payments 24/7 without the need for manual intervention, reducing the workload on customer service representatives. This automation streamlines payment processing, minimizes errors, and accelerates transaction times, resulting in a more efficient payment system.

2. Cost Savings:

Traditional payment methods, such as credit card transactions, often involve high processing fees. ACH payments, on the other hand, are generally more cost-effective, with lower transaction fees and reduced overhead costs. By adopting ACH IVR payments, businesses can save on processing fees and operational expenses, leading to substantial cost savings in the long run.

3. Improved Customer Experience:

IVR systems provide a user-friendly interface that allows customers to make payments quickly and easily. The convenience of making payments over the phone, combined with the security of ACH transactions, enhances the overall customer experience. Additionally, IVR systems can handle multiple languages and offer customizable prompts, catering to a diverse customer base and further improving satisfaction.

4. Increased Security:

Security is a critical concern in payment processing. ACH IVR payments leverage the robust security measures of the ACH network, including encryption and authentication protocols, to ensure the safety of transactions. Furthermore, IVR systems can be equipped with additional security features, such as voice recognition and two-factor authentication, providing an extra layer of protection against fraud and unauthorized access.

5. Scalability:

ACH IVR payment solutions are highly scalable, making them suitable for businesses of all sizes. Whether a small business with a limited number of transactions or a large enterprise processing thousands of payments daily, ACH IVR systems can be easily scaled to meet varying transaction volumes. This scalability ensures that businesses can grow without being constrained by their payment processing capabilities.

6. Integration with Existing Systems:

ACH IVR payment providers offer seamless integration with existing business systems, such as accounting software, customer relationship management (CRM) systems, and enterprise resource planning (ERP) solutions. This integration streamlines data flow, reduces manual data entry, and ensures accurate and up-to-date records, further enhancing operational efficiency.

How ACH IVR Payments Elevate Transaction Efficiency

1. Reducing Manual Processing:

Manual payment processing is time-consuming and prone to errors. ACH IVR payments automate the entire payment process, from data collection to transaction completion, eliminating the need for manual intervention. This automation reduces processing times, minimizes errors, and frees up valuable resources that can be allocated to more strategic tasks.

2. Minimizing Payment Delays:

Payment delays can disrupt cash flow and hinder business operations. ACH IVR payments facilitate real-time payment processing, ensuring that funds are transferred quickly and efficiently. This prompt payment processing improves cash flow management, enabling businesses to meet their financial obligations on time and avoid late payment penalties.

3. Enhancing Accuracy and Consistency:

Inaccurate payment processing can lead to financial discrepancies and customer dissatisfaction. ACH IVR payments enhance accuracy by automating data collection and transaction processing, reducing the likelihood of errors. The consistency of automated processes ensures that payments are processed correctly every time, providing businesses with reliable and accurate financial records.

4. Providing Real-Time Reporting and Analytics:

ACH IVR payment providers offer real-time reporting and analytics capabilities, allowing businesses to monitor payment activities and track key performance indicators (KPIs). These insights provide valuable information on payment trends, customer behavior, and transaction volumes, enabling businesses to make data-driven decisions and optimize their payment strategies.

5. Supporting Compliance and Regulatory Requirements:

Compliance with financial regulations is essential for businesses to avoid legal penalties and reputational damage. ACH IVR payment providers adhere to industry standards and regulatory requirements, ensuring that payment processes are compliant with relevant laws and guidelines. This compliance support helps businesses maintain their legal obligations and mitigate compliance risks.

Choosing the Right ACH IVR Payment Provider

When selecting an ACH IVR payment provider, businesses should consider several factors to ensure they choose the right solution for their needs:

1. Security Features:

Ensure that the provider offers robust security features, including encryption, authentication protocols, and fraud detection mechanisms, to protect sensitive payment information.

2. Integration Capabilities:

Evaluate the provider’s ability to integrate with existing business systems and software, such as accounting, CRM, and ERP solutions, to streamline data flow and improve operational efficiency.

3. Customization Options:

Look for providers that offer customizable IVR prompts and workflows to tailor the payment experience to your business requirements and customer preferences.

4. Scalability:

Choose a provider that can scale their solution to accommodate your business’s growth and changing transaction volumes, ensuring long-term suitability.

5. Customer Support:

Consider the provider’s customer support services, including availability, responsiveness, and expertise, to ensure you receive timely assistance when needed.

6. Cost Structure:

Review the provider’s pricing model, including transaction fees and any additional costs, to ensure it aligns with your budget and offers a cost-effective solution.

Conclusion

ACH IVR payments represent a powerful solution for businesses seeking to elevate transaction efficiency and enhance customer experience. By automating payment processes, reducing costs, and providing robust security, ACH IVR payment providers offer a comprehensive solution that meets the demands of modern commerce. Businesses can benefit from improved cash flow management, accurate financial records, and streamlined operations, making ACH IVR payments a valuable addition to their payment processing strategy. As the digital landscape continues to evolve, adopting ACH IVR payments can help businesses stay ahead of the curve and achieve long-term success.