In today’s digital economy, online marketplaces are growing exponentially. From e-commerce platforms like Amazon to gig economy hubs such as Uber or freelance sites like Upwork, marketplaces depend on seamless transactions between buyers, sellers, and service providers. For these platforms, optimizing payouts is crucial to ensuring smooth operations and increasing user satisfaction. One of the most effective methods to optimize marketplace payouts is through ACH (Automated Clearing House) payments.

In this article, we’ll explore what ACH payments are, how they work, and why they are a powerful tool for marketplaces looking to optimize payouts for users and businesses.

What are ACH Payments?

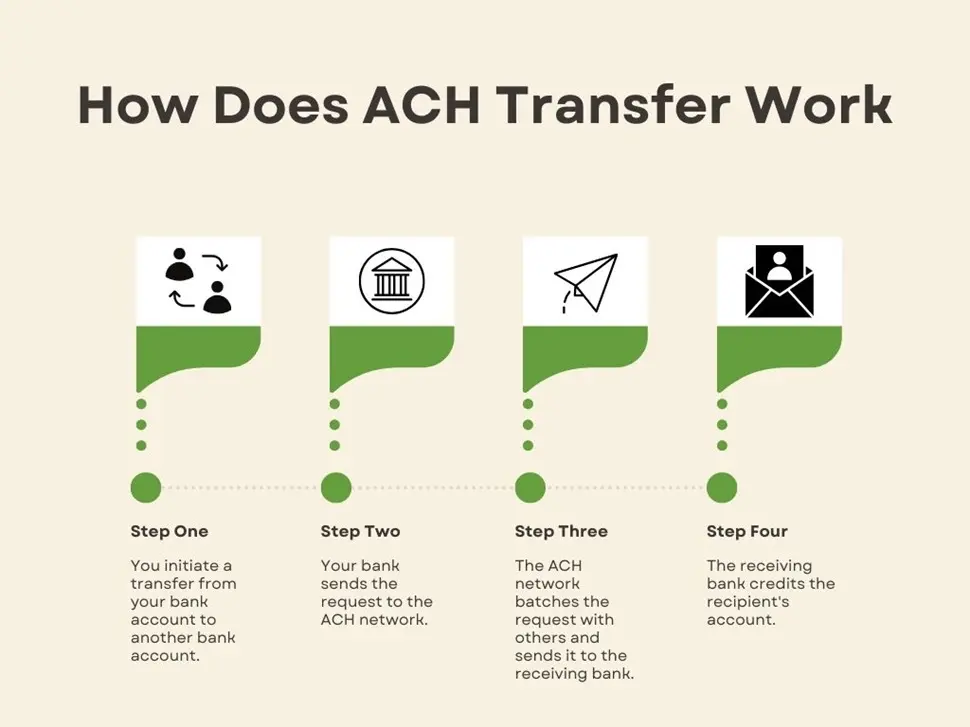

ACH payments refer to the electronic transfer of funds between banks within the United States. Unlike traditional wire transfers, which are processed in real-time and often incur higher fees, ACH payments are processed in batches, usually at scheduled times throughout the day. These transactions include various forms, such as direct deposits, bill payments, and person-to-person payments.

The National Automated Clearing House Association (NACHA) oversees the ACH network in the U.S., ensuring secure and efficient fund transfers between banks.

Why ACH Payments are Ideal for Marketplaces

Marketplaces that manage thousands or even millions of sellers and service providers face the challenge of distributing payouts efficiently and affordably. Here’s why ACH payments have become a preferred solution:

1. Cost Efficiency

One of the biggest advantages of ACH payments is their low cost compared to other forms of electronic payments, like credit cards or wire transfers. Traditional wire transfers can cost between $10 and $30 per transaction, which adds up significantly when marketplaces are paying large numbers of sellers. Credit card fees, on the other hand, typically range between 2.5% and 3.5% per transaction.

In contrast, ACH payments cost a fraction, often as low as $0.25 to $1 per transaction. For marketplaces that handle large-scale payouts, these savings can be substantial. This cost-effective option allows companies to allocate resources elsewhere, such as improving customer support or expanding the platform.

2. Faster Settlements

Before recent developments in the ACH network, traditional ACH transfers could take several business days. However, with the introduction of Same Day ACH, marketplaces can now process transactions within the same day, offering faster payouts to their users. For sellers, freelancers, and gig workers who depend on timely payouts to manage their cash flow, the speed of ACH payments is a game-changer.

Many platforms now leverage same-day ACH payments to meet the growing demand for faster funds transfers, and as the ACH system evolves, settlement times are expected to continue improving.

3. Security

Security is paramount for any financial transaction, especially for marketplaces where trust between users is vital. ACH payments are generally more secure than paper checks, which are vulnerable to theft and fraud. Additionally, ACH payments benefit from strong encryption and authentication protocols, making them a safer alternative to other payment methods.

By using ACH payments, marketplaces can provide sellers and service providers with peace of mind that their earnings will be transferred securely, without the risks associated with check fraud or compromised payment systems.

Key Benefits of ACH Payments for Marketplaces

In addition to cost efficiency, speed, and security, ACH payments offer a range of other advantages for marketplaces:

1. Automated and Scalable Payouts

Marketplaces often have thousands of sellers, making manual payments inefficient and error-prone. ACH payments are easily automated, allowing businesses to send multiple payouts simultaneously through batch processing. This automated approach not only saves time but also reduces the risk of human error.

Moreover, as a marketplace grows and its number of sellers increases, ACH payments scale efficiently, ensuring that platforms can handle larger payout volumes without additional resources.

2. Customizable Payment Schedules

Many marketplaces pay sellers or freelancers on a set schedule, such as weekly, biweekly, or monthly. ACH payments offer flexibility in setting payment schedules, allowing businesses to align payouts with their internal cash flow management or provide sellers with customized payout options.

Some platforms offer instant or on-demand payouts through ACH, giving sellers control over when they receive their funds, thereby enhancing the user experience and building loyalty among sellers.

3. Easier Reconciliation and Reporting

For marketplaces, managing transactions and reconciling payouts can be a complex and time-consuming task. ACH payments come with detailed reporting capabilities that simplify reconciliation. With ACH, businesses receive standardized transaction records, enabling them to keep track of payments efficiently.

By automating and streamlining this process, marketplaces can improve their financial reporting and provide transparent documentation to sellers, fostering greater trust and accountability.

Common Use Cases for ACH Payments in Marketplaces

ACH payments are versatile and can be applied to various types of marketplaces. Here are some common use cases:

1. E-commerce Marketplaces

Platforms like Amazon, Etsy, and eBay rely heavily on efficient payouts to sellers. By implementing ACH payments, these platforms can reduce transaction costs and improve payout times, ensuring a better experience for their sellers and ultimately enhancing the platform’s reputation.

2. Freelancing Platforms

Sites like Upwork and Fiverr cater to freelancers who expect regular payouts for their completed work. ACH payments allow these platforms to provide flexible and cost-effective solutions for freelancers who need their payments quickly, especially for international freelancers where other payment methods may be more expensive or slower.

3. Gig Economy Platforms

Gig economy platforms such as Uber, DoorDash, and Airbnb depend on efficient payouts to keep drivers, couriers, and hosts motivated. ACH payments streamline this process by offering faster, low-cost alternatives that benefit both the platform and the gig workers who rely on prompt payments to manage their personal finances.

How to Implement ACH Payments in Your Marketplace

For marketplaces looking to optimize payouts through ACH payments, the process is relatively straightforward. Here’s a step-by-step guide:

1. Choose a Payment Processor

The first step is selecting a payment processor or financial partner that supports ACH transactions. Many payment gateways and providers, like Stripe and PayPal, now offer ACH as part of their service packages, allowing for easy integration with existing payment workflows.

2. Integrate ACH Payments

Once you’ve selected a processor, you’ll need to integrate ACH into your marketplace’s payment infrastructure. Most providers offer APIs and documentation that simplify the integration process, ensuring that payouts can be processed securely and automatically.

3. Set Payout Schedules

Based on your business model and user preferences, configure payout schedules that suit both your platform and your sellers or service providers. Offering flexible payout options, such as on-demand payments or weekly transfers, can enhance the user experience and build trust within your marketplace.

4. Ensure Compliance

ACH payments are subject to compliance with NACHA rules and regulations. Be sure to stay up to date with the latest requirements and work with your payment processor to ensure full compliance. This step is critical for maintaining the security and integrity of your payment processes.

Conclusion

ACH payments provide a cost-effective, secure, and scalable solution for optimizing marketplace payouts. As marketplaces continue to grow and evolve, leveraging ACH payments offers businesses the flexibility and efficiency they need to meet user expectations and maintain a competitive edge. By incorporating ACH into their payout systems, marketplaces can streamline operations, reduce costs, and enhance user satisfaction—ensuring long-term success in the digital economy.