In the rapidly evolving digital payment landscape, businesses and consumers alike are constantly seeking secure, efficient, and cost-effective ways to transfer funds. Among the many payment methods available, eCheck payments stand out as a modern alternative to traditional paper checks. By leveraging the Automated Clearing House (ACH) network, eChecks provide a streamlined process for transferring funds electronically. But as with any payment method, eChecks come with their own set of advantages and risks. Understanding these can help businesses and consumers make informed decisions.

What is an eCheck?

An eCheck, or electronic check, is a digital version of a traditional paper check. It allows funds to be electronically transferred from a payer’s bank account to a recipient’s account through the ACH network. The process eliminates the need for physical checks, making it faster and more secure than traditional methods.

To initiate an eCheck payment, the payer provides their bank account details, routing number, and authorization. The ACH network processes the transaction, ensuring a seamless transfer of funds between accounts.

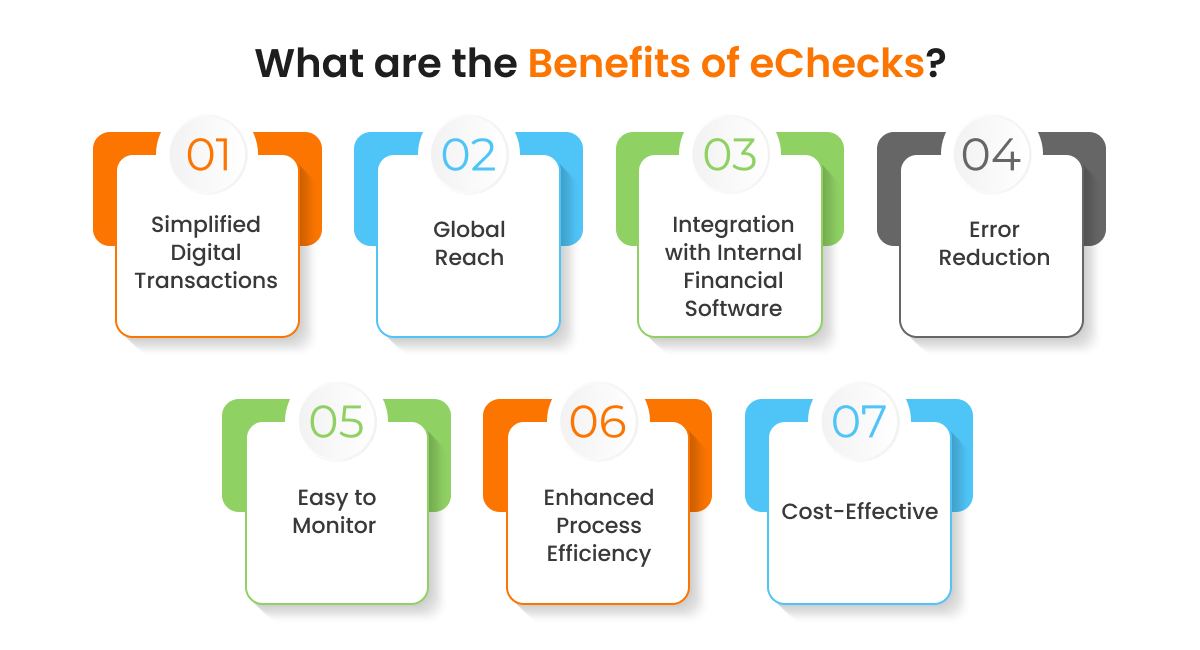

Benefits of eCheck Payments

eCheck payments offer several advantages, making them a popular choice for businesses and consumers alike:

1. Cost-Effectiveness

eCheck payments are often more affordable than other payment methods, such as credit card transactions, which typically involve higher processing fees. For businesses handling high volumes of transactions, eChecks can result in significant cost savings.

2. Enhanced Security

With robust encryption protocols and stringent authentication processes, eCheck payments are highly secure. Unlike paper checks, which can be lost or stolen, eChecks minimize the risk of fraud and unauthorized access.

3. Faster Processing

While traditional checks may take days to clear, eCheck payments are processed within a much shorter timeframe, often within 1–3 business days. This expedited process improves cash flow and reduces delays in receiving funds.

4. Eco-Friendly

By eliminating the need for paper, eChecks contribute to a more sustainable environment. Businesses that adopt digital payment methods can reduce their carbon footprint and align with eco-conscious practices.

5. Convenient for Recurring Payments

eCheck payments are ideal for recurring transactions, such as subscription services or installment payments. The automated nature of the process ensures timely and hassle-free payments.

Risks of eCheck Payments

Despite their benefits, eCheck payments are not without risks. Understanding these potential drawbacks is crucial for mitigating them effectively:

1. Processing Delays

While faster than paper checks, eCheck transactions are not instantaneous. Depending on the bank and network, processing may still take 1–3 business days, which could be an issue for time-sensitive transactions.

2. Insufficient Funds

If a payer’s account lacks sufficient funds, the eCheck may bounce, resulting in additional fees for both parties. Businesses must have protocols in place to address such situations.

3. Risk of Fraud

Although eChecks are generally secure, cybercriminals may attempt to exploit vulnerabilities in the payment system. Unauthorized access to bank account details can lead to fraudulent transactions.

4. Dependence on Technology

eCheck payments rely heavily on technology. Any disruption in internet connectivity, system outages, or technical errors can hinder the transaction process.

5. Limited Reversibility

Unlike credit card payments, which offer chargeback mechanisms, reversing an eCheck transaction can be challenging. This limitation may deter some consumers from using this payment method.

Best Practices for Secure eCheck Transactions

To minimize risks and maximize the benefits of eCheck payments, businesses and consumers should follow these best practices:

- Use Trusted Payment Processors: Partner with reputable ACH payment processors that prioritize security and compliance.

- Implement Fraud Detection Tools: Utilize tools that monitor transactions for suspicious activity and unauthorized access.

- Educate Customers: Provide clear instructions on how to use eCheck payments securely, including safeguarding their banking information.

- Maintain Updated Software: Ensure that all payment systems and software are up to date to prevent vulnerabilities.

- Establish Clear Policies: Outline terms and conditions for eCheck payments, including procedures for handling insufficient funds or disputed transactions.

Common FAQs About eCheck Payments

1. How does an eCheck differ from a traditional paper check?

An eCheck is a digital version of a paper check that processes payments electronically through the ACH network. Unlike paper checks, eChecks eliminate the need for physical handling and are faster and more secure.

2. Are eCheck payments secure?

Yes, eCheck payments are highly secure. They use encryption, authentication, and secure ACH processing to protect sensitive information and reduce the risk of fraud.

3. How long does it take for an eCheck to clear?

eCheck payments typically take 1–3 business days to clear, depending on the bank and ACH processing times.

4. What are the fees associated with eCheck payments?

eCheck processing fees are usually lower than credit card transaction fees, making them a cost-effective option for businesses.

5. Can eCheck payments be reversed?

Reversing an eCheck payment is possible but more challenging compared to credit card chargebacks. Businesses should establish clear refund policies to handle such cases.

6. Who can benefit from using eCheck payments?

eCheck payments are suitable for businesses of all sizes, particularly those handling recurring transactions, large-ticket items, or high volumes of payments.

7. What information is required to process an eCheck?

To process an eCheck, the payer must provide their bank account number, routing number, and authorization for the transaction.

8. What should I do if an eCheck payment fails due to insufficient funds?

Businesses can implement policies to notify customers of failed payments and offer alternative methods to complete the transaction.

9. Are eChecks eco-friendly?

Yes, eChecks reduce paper waste, making them an environmentally friendly alternative to traditional checks.

10. How can I start accepting eCheck payments?

To accept eCheck payments, businesses need to partner with an ACH payment processor, set up a merchant account, and integrate the necessary software into their payment systems.

Conclusion

eCheck payments offer a compelling combination of cost-effectiveness, security, and convenience, making them an attractive option for businesses and consumers in the digital age. While they come with certain risks, implementing best practices and choosing trusted payment processors can mitigate these challenges effectively.

By understanding the intricacies of eCheck payments, businesses can optimize their payment processes, enhance customer satisfaction, and align with the growing demand for digital financial solutions. As the payment landscape continues to evolve, embracing methods like eChecks can position businesses for long-term success.