In the realm of digital payments, Automated Clearing House (ACH) transactions have become a cornerstone for businesses looking to streamline their financial operations. With lower fees than credit cards and a more efficient process than paper checks, ACH payments offer a reliable and cost-effective way to move money electronically. However, understanding the differences between ACH Push and ACH Pull methods is crucial for determining which option best fits your business needs.

In this blog, we’ll take an in-depth look at ACH Push and ACH Pull, explore their unique features, and help you decide which method aligns with your business strategy.

What is ACH?

Before diving into the specifics of ACH Push and ACH Pull, let’s briefly cover what ACH is. The ACH network is a U.S.-based system that processes electronic financial transactions between banks. It’s widely used for direct deposits, bill payments, and transferring funds between accounts. ACH transactions are processed in batches, which makes them less instantaneous than wire transfers but more cost-effective.

Understanding ACH Push

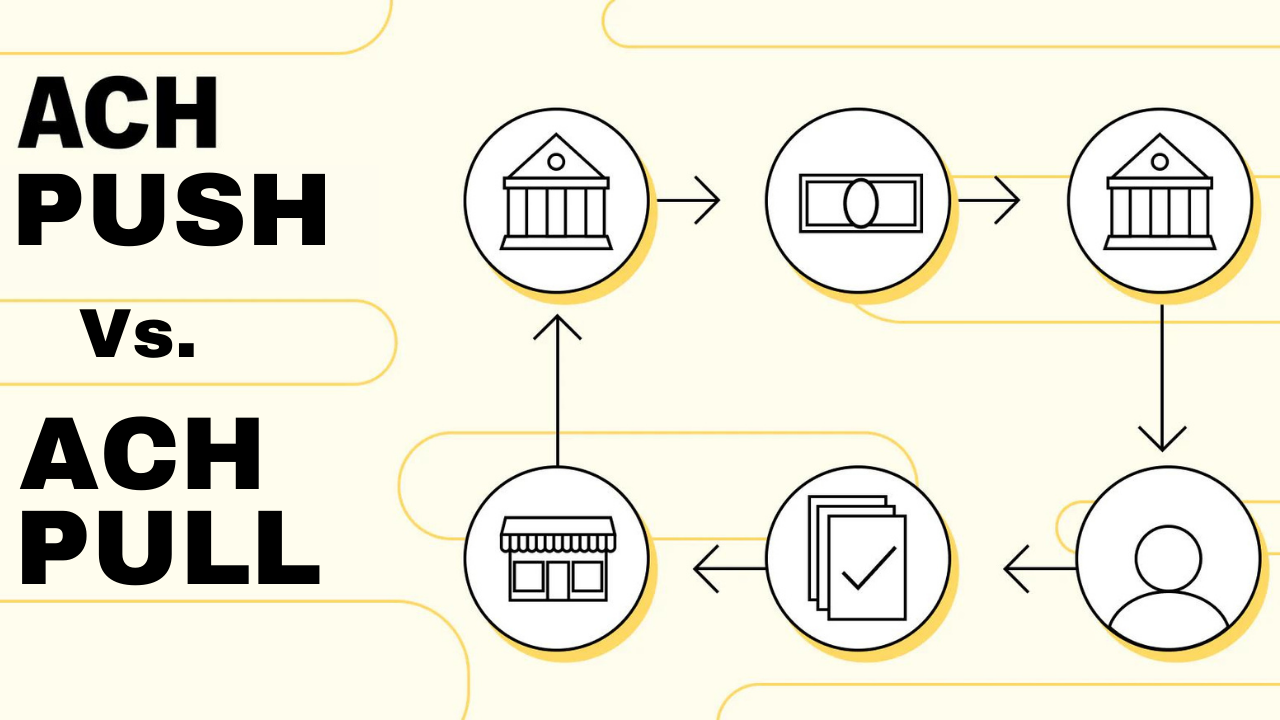

ACH Push is a method where the payer (typically the customer) initiates the transfer of funds from their bank account to the payee’s (typically the business) account. In other words, the customer is “pushing” money to the business. This method is commonly used in situations where the customer has control over when and how much money is transferred.

Key Features of ACH Push:

- Customer Control: The customer initiates the payment, giving them control over the timing and amount of the transaction.

- Security: Since the business does not have direct access to the customer’s bank account, the ACH Push method is often considered more secure from the customer’s perspective.

- Payment Confirmation: Businesses receive a payment confirmation when the transaction is initiated, which can help in reconciling accounts.

- Lower Risk of Chargebacks: Because the customer controls the payment, the risk of disputes and chargebacks is reduced.

Common Uses of ACH Push:

- Bill Payments: Customers pay utility bills, rent, or other recurring expenses by initiating a payment from their bank account.

- One-Time Payments: Individuals can use ACH Push for one-time payments, such as purchasing products or services online.

Understanding ACH Pull

ACH Pull is a method where the payee (typically the business) initiates the transfer of funds from the payer’s (typically the customer’s) bank account to their own account. Essentially, the business is “pulling” money from the customer’s account. This method is often used for recurring payments, such as subscriptions or automatic bill payments.

Key Features of ACH Pull:

- Business Control: The business initiates the transaction, allowing for more consistent and timely payments.

- Convenience: Customers don’t have to manually initiate payments, making it easier for businesses to collect recurring payments.

- Automated Processes: ACH Pull is ideal for automating payments, reducing the need for manual intervention and improving cash flow.

- Authorization Required: Customers must authorize the business to pull funds from their account, typically through a signed agreement or online authorization.

Common Uses of ACH Pull:

- Subscription Services: Businesses offering subscription-based services use ACH Pull to automatically deduct payments from customers’ accounts on a recurring basis.

- Utility Payments: Utility companies may use ACH Pull to automatically collect payments from customers each billing cycle.

- Loan Repayments: Financial institutions may use ACH Pull to collect loan payments automatically from borrowers’ accounts.

ACH Push vs. ACH Pull: Pros and Cons

ACH Push – Pros:

- Customer Empowerment: Customers appreciate having control over their payments, which can improve satisfaction and trust.

- Reduced Dispute Risk: Since customers initiate the payment, there’s less risk of disputes and chargebacks.

- Enhanced Security: Businesses don’t need to store sensitive banking information, reducing the risk of data breaches.

ACH Push – Cons:

- Inconsistent Payment Timing: Since customers control when payments are made, businesses may face delays in receiving funds.

- Manual Processing: ACH Push may require more manual intervention, particularly if customers forget to make payments on time.

- Potential for Missed Payments: Without automation, there’s a higher risk of missed or late payments, impacting cash flow.

ACH Pull – Pros:

- Automation: ACH Pull allows businesses to automate payment collection, reducing the risk of late or missed payments.

- Predictable Cash Flow: With payments automatically deducted, businesses can better predict their cash flow.

- Convenience for Customers: Customers don’t need to remember to make payments, which can enhance their overall experience.

ACH Pull – Cons:

- Higher Risk of Disputes: Since the business initiates the payment, customers may dispute charges if they feel they were unauthorized or incorrect.

- Authorization Requirements: Businesses must obtain explicit authorization from customers, which can add an extra step to the onboarding process.

- Security Concerns: Storing customer banking information can pose security risks, especially if not handled properly.

Which ACH Method is Right for Your Business?

Choosing between ACH Push and ACH Pull depends on your business model, payment needs, and customer preferences. Here are some factors to consider:

- Type of Business: If your business relies on recurring payments (e.g., subscriptions or memberships), ACH Pull may be the better choice due to its automation and consistency. Conversely, if your business involves one-time payments or allows customers to pay on their own schedule, ACH Push could be more appropriate.

- Customer Experience: Consider how each method impacts your customers. Do they prefer control over their payments, or do they value convenience? Understanding your customer base will help you make the right choice.

- Cash Flow Requirements: If consistent cash flow is critical to your operations, ACH Pull may provide the reliability you need. However, if you can tolerate variability in payment timing, ACH Push may suffice.

- Security and Compliance: Both methods require adherence to security and compliance standards, but ACH Push may offer greater peace of mind for customers concerned about data security.

Integrating eCheck Payments with ACH

For businesses looking to offer even more payment flexibility, integrating eCheck payments with ACH can be a game-changer. eCheck payments work similarly to ACH transactions but are specifically designed for electronic check processing. This method allows customers to make payments directly from their checking accounts, providing an alternative to traditional ACH transfers.

Benefits of eCheck Payments:

- Lower Fees: eCheck transactions typically involve lower processing fees compared to credit cards, making them a cost-effective option for businesses.

- Expanded Payment Options: Offering eCheck payments alongside ACH Push and Pull gives customers more choices, enhancing their payment experience.

- Efficiency: Like ACH, eCheck payments are processed electronically, reducing the time and effort required for manual check handling.

Conclusion

Both ACH Push and ACH Pull offer unique advantages depending on your business needs and customer preferences. By carefully evaluating the pros and cons of each method, you can select the best payment solution for your business. Additionally, considering the integration of eCheck payments can further enhance your payment processing capabilities, providing a comprehensive and efficient system for managing transactions.

In the ever-evolving world of digital payments, understanding your options is key to optimizing your financial operations and ensuring a seamless experience for both your business and your customers.